SVB ou l’éclatement de la bulle du capital-risque

Jacques, , Article du mois, Financial Stability, Governance, Incentives, Systemic Convergence, 0Bulle du capital-risque La faillite de la Silicon Valley Bank (SVB), la 16ème banque américaine et la 2ème faillite...

Chine: quand l’immobilier va, tout va

Jacques, , Article du mois, Credit, French, Growth, Inflation / Yield curves, 0Le modèle économique chinois est-il cassé? Cette belle vidéo du Financial Times s'interroge sur le modèle économique chinois de...

Choc énergétique et réallocation du capital

Jacques, , Article du mois, Credit, Financial Stability, Inflation / Yield curves, Oil, 0Choc énergétique Plusieurs explications s'offrent à nous pour appréhender le choc énergétique en cours. Pour rappel, les prix du...

Inflation: débat public et stabilité financière

Jacques, , Article du mois, Financial Stability, Incentives, Inflation / Yield curves, Public Authorities, Systemic Convergence, 0Débat sur l’inflation ... et la stabilité financière Après avoir vivement critiqué l'ampleur des paquets fiscaux de l'administration Biden,...

Pile je gagne, face tu perds: aléa moral et stratégies ‘zéro risque’

Jacques, , Article du mois, Financial Stability, French, GRAND ANGLE, Systemic Convergence, 0Aléa moral et structure d'incitations Les pics de volatilité, les tensions de valorisation, la hausse des taux d'intérêt et...

Tensions sociales et concentration boursière

Jacques, , Article du mois, Public Authorities, Social Unrest, Systemic Convergence, 0Wall Street vs Main Street On a beaucoup parlé de l’alphabet économique de la crise du covid (V, W,...

Japanification: problème ou opportunité?

Jacques, , Article du mois, Credit, French, Social Unrest, 0Japanification Un sujet d'actualité que parcourt cette video du Financial Times à la marge de la dernière rencontre de...

Bonne année 2020! Le patient économique se trouve toujours sous perfusion monétaire. Il montre des signes de fébrilité assez...

Flash PMI: souriez, la croissance est de retour!

Jacques, , Article du mois, Credit, French, GRAND ANGLE, Growth, 0Les derniers indices flash PMIs d’IHS Markit offrent une nouvelle opportunité de taquiner la rhétorique économique du moment. Ce...

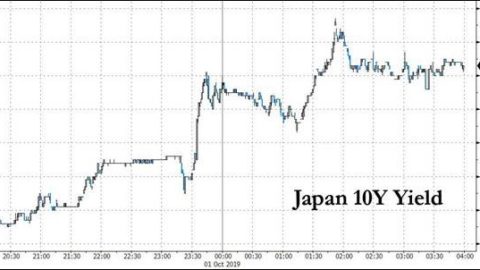

Taux négatifs et liquidité obligataire Ce billet de ZeroHedge nous en dit un peu plus en matière de risques...

Effet technique ou systémique ? Ce billet revient sur les turbulences du 'Repo' qui ont forcé la Réserve...

Stable, stable, … instable

Jacques, , Article du mois, Financial Stability, French, Governance, Public Authorities, 0De sérieuses questions de politique économique se posent après plus de 10 ans de mesures non-conventionnelles, de croissance à...

Histoires (économiques) extraordinaires

Jacques, , Article invité, Croissance, French, GRAND ANGLE, 2Des facteurs extraordinaires En l’espace de quelques mois, la conjoncture mondiale est soudainement passée d’une croissance robuste et synchronisée...

Croissance mondiale en fin de cycle Encore une statistique ‘inattendue’ qui nous renseigne sur l’état de santé de la...

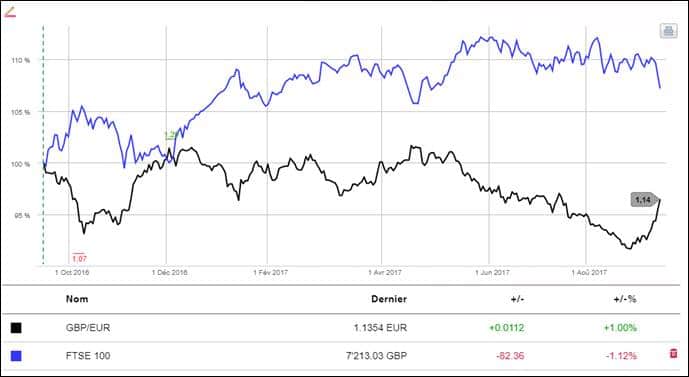

Brexit: normalisation avec ou sans ‘deal’

Jacques, , Article du mois, French, GRAND ANGLE, Social Unrest, 0Les impacts du Brexit Bloomberg s'intéresse au marché obligataire afin d'évaluer les impacts macro-financiers d'un Brexit 'désordonné': aplatissement de...

Dans le sillage du dernier meeting de la Fed, ce billet * s’intéresse à la moneyness du ‘Greenspan put’,...

A case study of macro-credit Australia is far and close from the USA and Europe, at the same time....

Leaning against the wind: la Fed à contre-courant

Jacques, , Article du mois, Central Banks, Systemic Convergence, 0Les dessous de l’actualité financière suite au discours du Président de la Fed, sous l’oeil attentif de quelques manchettes...

US economic policies at the crossroads

Jacques, , Article du mois, Central Banks, English, Fiscal policy, Public Authorities, 0Another way to appreciate the fundamental ‘change of regime’ that is shaking the markets throughout the world. Economic policies...

Contra(di)ction chinoise

Jacques, , Article invité, French, General, GRAND ANGLE, Systemic Convergence, 0Kenneth Rogoff, que l’on ne présente plus, propose un article incontournable dans Project Syndicate: “The Global Impact of a...

Cryptos et régime de marchés Il faut parfois savoir sortir des sentiers battus pour mieux cerner les enjeux de...

Share buybacks: money for nothing ?

Jacques, , French, Governance, Incentives, Systemic Convergence, 0Share buybacks et dividendes Un communiqué de presse récent de S&P Dow Jones Indices, relayé par plusieurs media...

Balance budgétaire US et valorisation du risque de crédit souverain

Jacques, , Fiscal policy, French, Government, Public Authorities, 1Balance budgétaire US Les taux peuvent-ils augmenter dans un contexte de croissance et d’inflation atones ? Nous suggérons que...

Pétrole: un dernier tango de ‘guidance’ ?

Jacques, , Financial Stability, French, Governance, Incentives, Systemic Convergence, 0La perspective d’une intervention au Moyen-Orient fait bondir le prix du pétrole. Ce billet propose plusieurs coups de projecteur...

Rencontre avec M. Consensus

Jacques, , Article invité, French, GRAND ANGLE, Offbeat, Social Unrest, Systemic Convergence, 0M. Consensus est ce que l’on pourrait appeler un influenceur : un avis sur tout, toujours du côté du...

Establishment, gouvernance publique et tensions sociales

Jacques, , French, Governance, Social Unrest, Systemic Convergence, 0Benoît Coeuré, membre du Directoire de la banque centrale européenne, accordait hier un entretien à BFM Business TV dont...

Le retour des tensions sociales

Jacques, , Article du mois, Credit, Economics & Finance, French, Growth, Social Unrest, Systemic Convergence, 0Etats-Unis, Angleterre, Italie : les tensions sociales occupent à nouveau le devant de la scène. Elles nous intéressent autant...

Avis aux ‘marketing guys’ : les propositions de ce billet contiennent des points de vue susceptibles de choquer leurs...

Bulles d’air, air du temps Les bulles financières ne manquent pas d’air, surtout lorsqu’elles sont alimentées par l’air du...

The spike of earnings that hides behind the recent equity run-up has a lot to do with peculiar business...

Valuing equity valuation

Jacques, , Credit, Economics & Finance, English, Growth, Inflation / Yield curves, 0Equity valuation has been a hot topic of late. Rightly so. The Big Picture drew our attention on this...

Low (inflation) is in the air

Jacques, , Economics & Finance, English, GRAND ANGLE, Growth, Inflation / Yield curves, 0The latest World Economic Outlook of the IMF has just been issued. Low inflation is in the air ......

When China drives the ‘financial and international developments’ of the Fed

Jacques, , Central Banks, English, Public Authorities, 0China and the Fed Our macro-credit radar is flashing red again. Interestingly enough, this happens at the crossroad of...

And further taper guidance by the Bank of England

Jacques, , Central Banks, English, Public Authorities, Systemic Convergence, 0Further market developments following the flow of taper guidance issued recently … this time by the Bank of England....

Additional taper guidance by the ECB

Jacques, , Central Banks, English, Public Authorities, Systemic Convergence, 0The European Central Bank provides additional guidance about its own version of monetary policy tapering, almost live from the...

FX volatility: a balancing act

Jacques, , English, Fiscal policy, Governance, Public Authorities, Systemic Convergence, 0In this post we take a closer look at the recent dynamics of the USD. Relative expectations and economic...

USD: Game of expectations

Jacques, , Economics & Finance, English, Fiscal policy, Growth, Inflation / Yield curves, Public Authorities, 0The Wall Street Journal digs into the recent equity valuation boost foreseen in our previous note. Beware however, the...

Banks, the yield curve and the USD

Jacques, , Banks, Central Banks, English, Fiscal policy, Government, Public Authorities, 4The US banking sector had a bumpy ride recently, almost as rocky as the mountain of expectations surrounding the...

Growth expectations down, interest rates up: the latest PMI figures and bond market developments seem to fit into our...

Incentivos financieros, el efecto mariposa

Jacques, , Governance, Incentives, Spanish, Systemic Convergence, 0Ya lo sé. El tema parece muy lejos de los mercados y de nuestros asuntos diarios. De hecho es...

Sometimes economic and market developments combine and force us to focus our interventions. As foreseen some time ago, things...

Polls and expectations: two sides of the same coin

Jacques, , Economics & Finance, English, Growth, Social Unrest, Systemic Convergence, 0A brief follow-up of our previous note: ‘UK: peak economy and peak public’. As a reminder, this is about the...

Moody’s downgrades China: the risk repricing scenario, live

Jacques, , Credit, Economics & Finance, English, Growth, 0A real-time follow-up of our risk repricing scenario. Moody’s downgrades China’s sovereign rating by one notch, from Aa3 to...

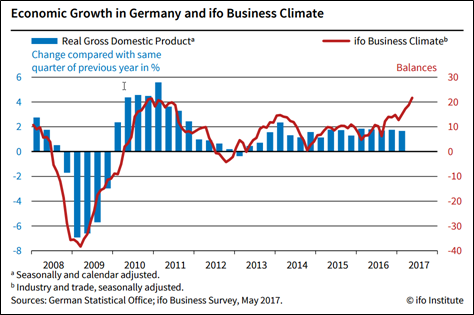

From the US to Europe: “Mind the gap”

Jacques, , Economics & Finance, English, GRAND ANGLE, Growth, 0Various European climax indicators have been published recently. They look like a distant remake of an economic movie made of...

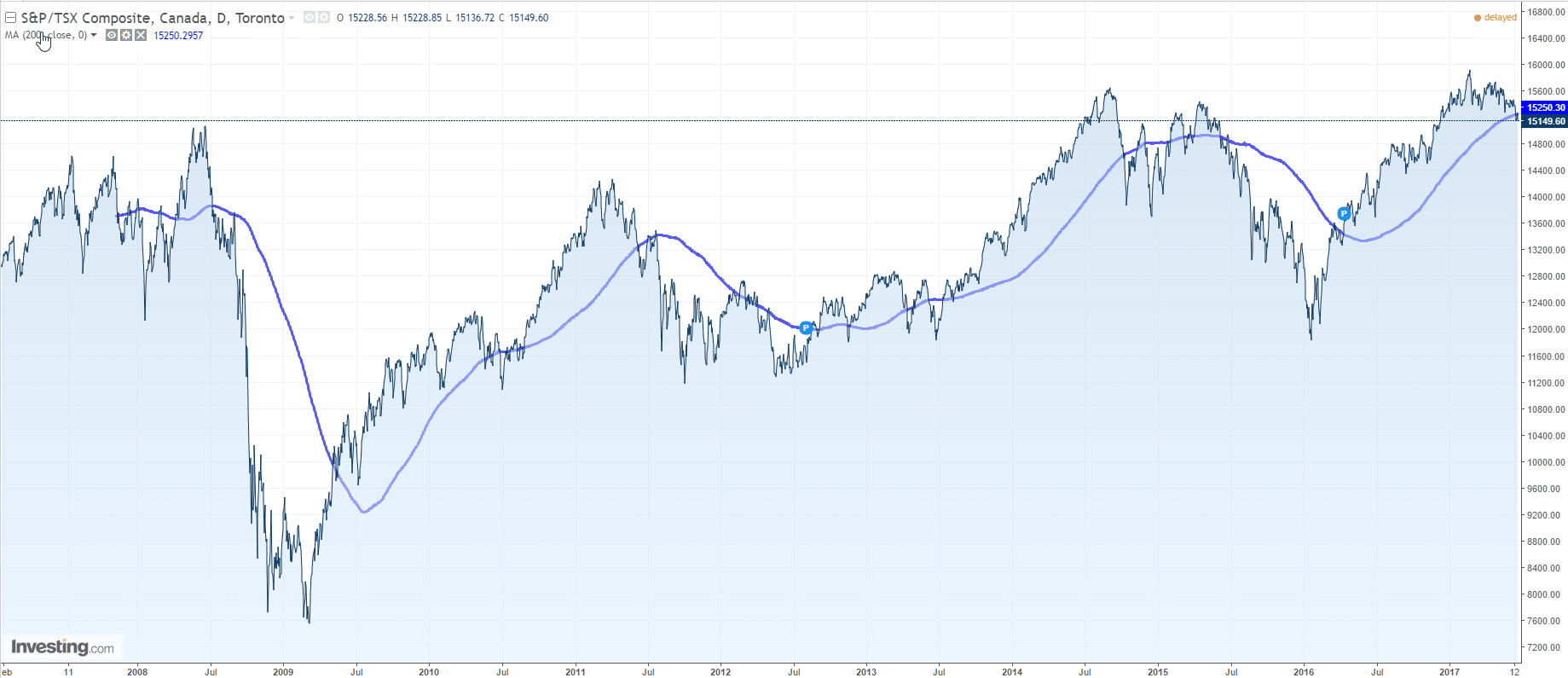

Canadian Banks downgraded by 1 notch, outlook negative

Jacques, , Banks, Central Banks, Credit, Economics & Finance, English, Growth, Oil, Public Authorities, 0A brief update of our latest posts about oil supply, credit and Canadian real Estate. The rating agency Moody’s...

Oil prices have fallen more than 10% since the beginning of the year, in spite of the agreement reached by...

UK: peak economy and peak public

Jacques, , English, Fiscal policy, Government, GRAND ANGLE, Public Authorities, 0George Magnus seems to share the idea of some economic timing behind the recent announcement of a snap general...

In this series of posts we focus on various developments – some of which have been heavily advertised of...

Matières premières, carry financier et solvabilité : le cas de l’immobilier canadien

Jacques, , French, GRAND ANGLE, 0On sait le marché immobilier plutôt tendu dans les économies ‘à taux zéro’, c’est-à-dire à peu près toutes les...

Arnaud Masset de Swissquote évalue dans le journal Le Temps la politique de change que poursuit la Banque Nationale Suisse...

Oil and credit risk: the case of Saudi Arabia

Jacques, , Credit, Economics & Finance, English, Growth, Oil, 0The rating agency Fitch gives a nice opportunity to assess the dynamics of the ‘oil carry’ in today’s brave...

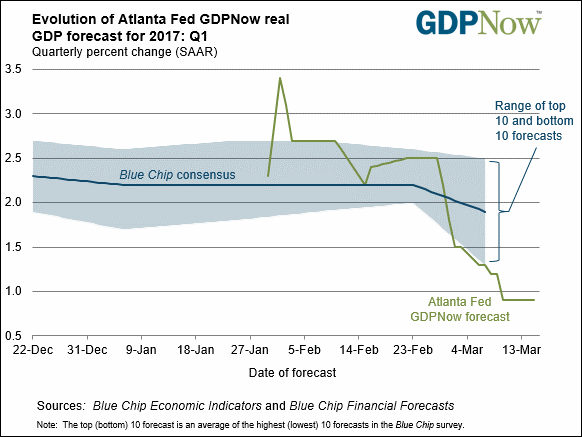

Nowcasts, a contraction of current economic conditions (now) and forecasts, have been attracting a lot of attention of late....

Speed bump: early signs of landing

Jacques, , Economics & Finance, English, Growth, Inflation / Yield curves, 5The latest Global PMI indicators of JPMorgan give an insightful picture about the fading momentum of US and UK...

The real effect of fiscal guidance: circle or circus ?

Jacques, , English, Fiscal policy, GRAND ANGLE, 0Same markets, same statistics, two sets of propositions. Make your mind ! Is the ‘Trump effect’ real ? The...

Reality Check ?

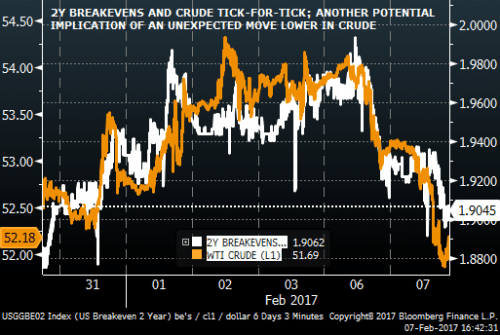

Jacques, , Credit, Economics & Finance, English, Growth, Inflation / Yield curves, Oil, 0Let us dig into oil, inflation expectations and interest rates. The latest developments look like a material pause in the current...

Micro-supervision: Macro-fissures

Jacques, , English, Financial Stability, Governance, GRAND ANGLE, 0It is often perilous (and always expensive for the common good) to be in charge of executive and controlling...

Financial stability as a policy weapon? Another governance failure

Jacques, , English, Financial Stability, Governance, Social Unrest, Systemic Convergence, 0The aftermath of the Italian referendum sheds an insightful light on the latest financial stability report of the ECB. We suggest that the...

Les ‘conséquences inattendues’ du manque de transparence

Jacques, , English, Financial Stability, Governance, Systemic Convergence, 0Cet article du bouillonnant Stéphane Garelli soulève une question centrale en matière de politique d’investissement: les ‘conséquences inattendues’ des mesures monétaires...

Yet another emerging tantrum … James Mackintosh makes a nice parallel in the the Wall Street Journal between the...

A short follow-up of our previous post ‘Bank of Japan: backward guidance’. As a reminder, in this process of...

Connecting the dots: oil prices, credit and interest rates – from one shock to the other

Jacques, , Credit, Economics & Finance, English, Growth, Inflation / Yield curves, Oil, 0Oil prices deserve a special attention in the aftermath of the US election. Connecting the dots, we believe that...

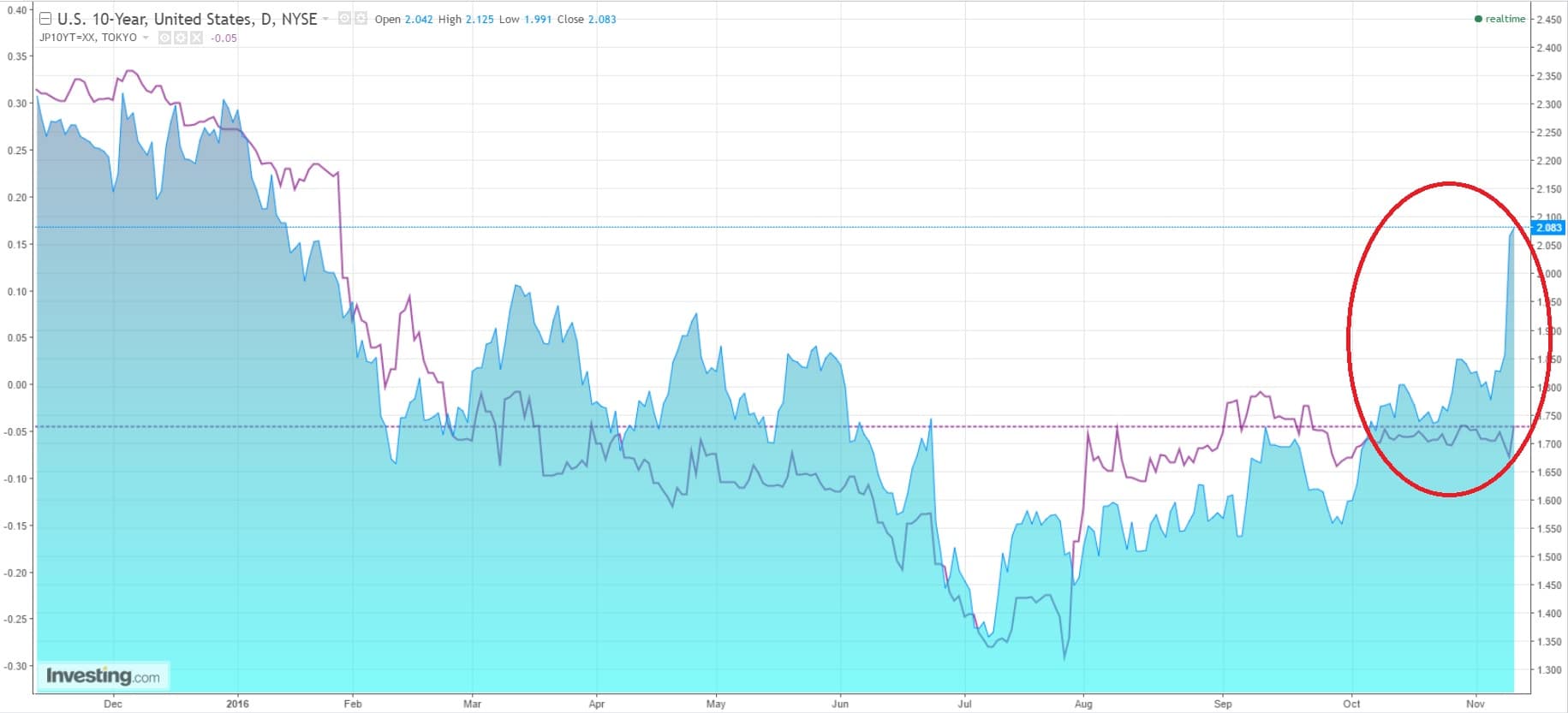

Interest rates and credit repricing: live

Jacques, , English, GRAND ANGLE, Inflation / Yield curves, 2We stick to our previous statements: the rise in interest rates is less related to some sudden expectations...

Elections US: entre tensions sociales et poudre des banques centrales

Jacques, , French, GRAND ANGLE, 0Les tensions sociales, en l’occurrence leur expression politique, ont un impact significatif sur l’environnement macro-financier de l’après-crise financière. A l’instar...

Ratio de dette publique ... Ce billet extrait de Bank Underground, un beau blog de la banque d’Angleterre,...

The exit strategy of the Bank of Japan looks like a well-structured communication process: Step 1: announce...

Deutsche Bank: normalization and systemic risks

Jacques, , Banks, Central Banks, English, Financial Stability, Public Authorities, Systemic Convergence, 0The recent news by Bloomberg is now confirmed by the media. The damage is done. Interestingly enough, the...

Rock stars at Jackson Hole

Jacques, , Central Banks, English, Financial Stability, Governance, Public Authorities, Systemic Convergence, 2Forward guidance A short, spicy and refreshing post by John Taylor, the famous economist of the well-known Taylor...

Banks, Brexit and Contagion

Jacques, , Banks, Central Banks, English, GRAND ANGLE, Public Authorities, 0Banks, European ones in particular, may play a central role in the post Brexit world. A lot of attention...

Autorités publiques: chronique d’un échec annoncé – le retour de la BRI (3)

Jacques, , Financial Stability, French, Governance, Systemic Convergence, 0Le sujet n’est pourtant pas nouveau. Dans l’indifférence quasi-générale, la banque des règlements internationaux (la BRI) exprimait de longue...

Autorités publiques: chronique d’un échec annoncé – lacunes de gouvernance (2)

Jacques, , French, Governance, Systemic Convergence, 0Pour certains elle est un mal nécessaire, pour d’autres une raison d’être, pour les derniers enfin un de ces...

Autorités publiques: chronique d’un échec annoncé (1)

Jacques, , French, Governance, Systemic Convergence, 0Bonjour, Annoncé de longue date, l’échec des autorités publiques est à présent consommé. Après avoir étudié le retour aux...

Voici la version française du post “Regime shift, systemic convergence and financial stability”. Le régime monétaire mis en place ces...

Negative interest rates for negative results

Jacques, , Central Banks, English, Public Authorities, 0Negative interest rates The risk-on mood has been powerful these days. I stick to my recommendation of a cautionary...

Regime shift, systemic convergence and financial stability

Jacques, , English, Financial Stability, GRAND ANGLE, 0The monetary regime in place in recent years shows signs of fatigue. The cost/benefit ratio of public policy...

Capital flows Happy New Year ! Carmen Reinhart’s research about debt, capital flows and financial crises became popular...

Fed hike: mission accomplished ? Not really …

Jacques, , Central Banks, English, Public Authorities, 0The latest decision of the Fed is described as THE turning point of the US zero interest rate...

Ce billet date de décembre 2015. Souvenez-vous: l'année était (déjà!) marquée par des turbulences chinoises significatives. Le modèle de...

It’s Central Bank’s time. It is also time to recall some of our propositions with regards to public authorities...

Nader vs. Yellen: Social unrest and power shift

Jacques, , English, Governance, Social Unrest, Systemic Convergence, 0Please consider this interesting exchange of open letters between Ralph Nader, the ex-candidate to the US Presidency, and Janet Yellen,...

Central Banks: Firewalls and Governance

Jacques, , Central Banks, English, Financial Stability, Governance, Public Authorities, Systemic Convergence, 0This note is about the recognition of policy failures by public authorities and their consequences on financial stability. Our...

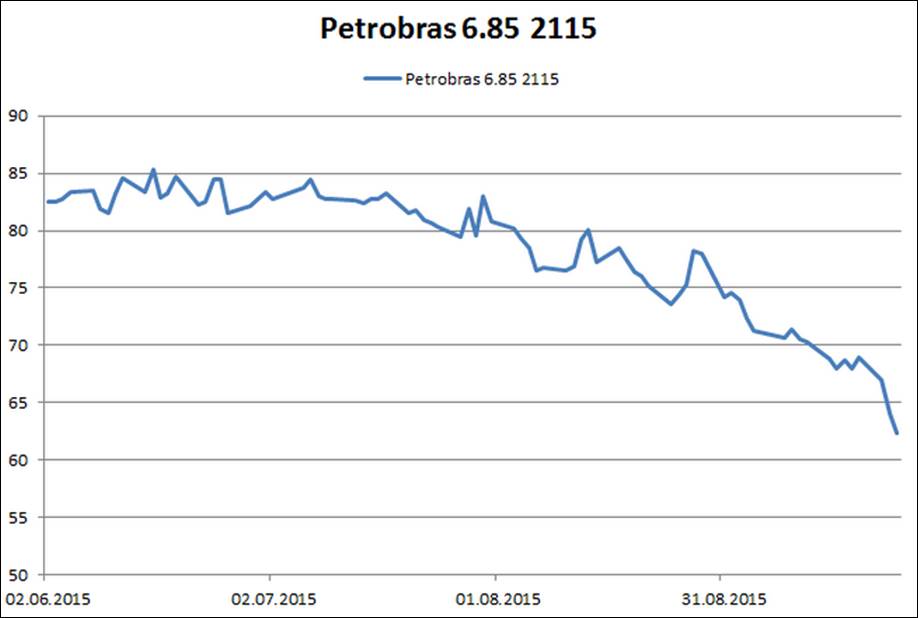

High yield, credit risk and carry trade: the case of Petrobras

Jacques, , Credit, Economics & Finance, English, 0Please consider the following post from the excellent blog ‘Never Mind the Markets’ of the Swiss German Tages-Anzeiger. Source:...

Dear All, Some takeaways following yesterday’s decision by the Fed. The ‘exit logic’ has been in force since the...

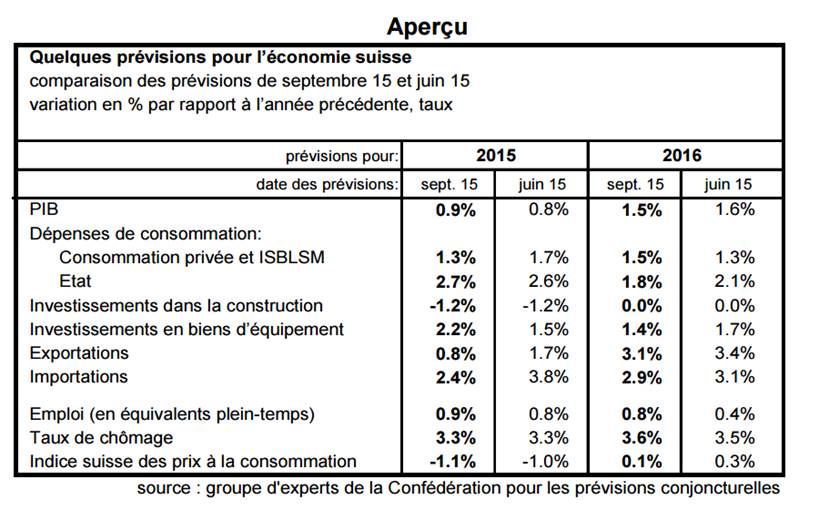

Bonjour, Un billet à la marge des derniers communiqués du Secrétariat d’Etat à l’économie (SECO) et de la Banque...