The rating agency Fitch gives a nice opportunity to assess the dynamics of the ‘oil carry’ in today’s brave reflationary world, i.e. the way oil prices impact sovereigns and corporates’ solvency.

Interestingly enough, the downgrade of Saudi Arabia happens as oil prices declined by more than 10% since the beginning of the year.

Please go to ‘Fitch Downgrades Saudi Arabia to ‘A+’; Outlook Stable’ for the full statement by Reuters.

This post takes a broader macro-financial perspective : it focuses on the oil carry as a milestone of our (market challenging) ‘credit risk repricing scenario’.

From the Fitch statement:

(emphasis ours)

“The downgrade of Saudi Arabia’s LongTerm IDRs reflects the continued deterioration of public and external balance sheets, the significantly wider than expected fiscal deficit in 2016 and continued doubts about the extent to which the government’s ambitious reform programme can be implemented.” |

Public and external balance sheets, as well as fiscal deficits, are deep macro variables in the current environment.

Saudi Arabia does not escape the fiscal logic expressed by Fitch. Any resemblance with other countries would of course be purely coincidental …

“ These measures will help to contain further balance sheet erosion, but in Fitch’s view it is unlikely that they will all be achieved. The FBP itself is ambitious and comes together with reforms to reduce Saudi Arabia’s oil dependence, including the IPO of Saudi Aramco planned for 2018 and an ambitious privatisation agenda (our fiscal forecasts contain no IPO/privatisation receipts as these will probably be transferred to the Public Investment Fund) as well as numerous sectoral initiatives. The commitment of the political leadership to the reform programme is very strong. However, in Fitch’s view, the scale of the reform agenda risks overwhelming the government’s administrative capacity. In addition, the economy may not be able to absorb rises in administered energy prices, which could severely affect energy intensive industries, or the planned expat levies, which could undermine large parts of the domestic private sector.” |

In other words: it is extremely difficult to move from an oil-driven economic model to a more diversified one.

Likewise, any resemblance with other monocultural economies would be fortuitous.

“GDP grew by 1.4% in 2016 according to preliminary data, with a rise in oil sector GDP of 3.4% and an increase in the nonoil sector by just 0.2%. Weak nonoil growth reflected the liquidity crunch due to the delay of government payments during the first three quarters of last year and the increased uncertainty as a result of the reform efforts, which may have held back investment.” |

‘Weak non-oil growth reflected the liquidity crunch due to the delay of government payments during the first quarters of last year’.

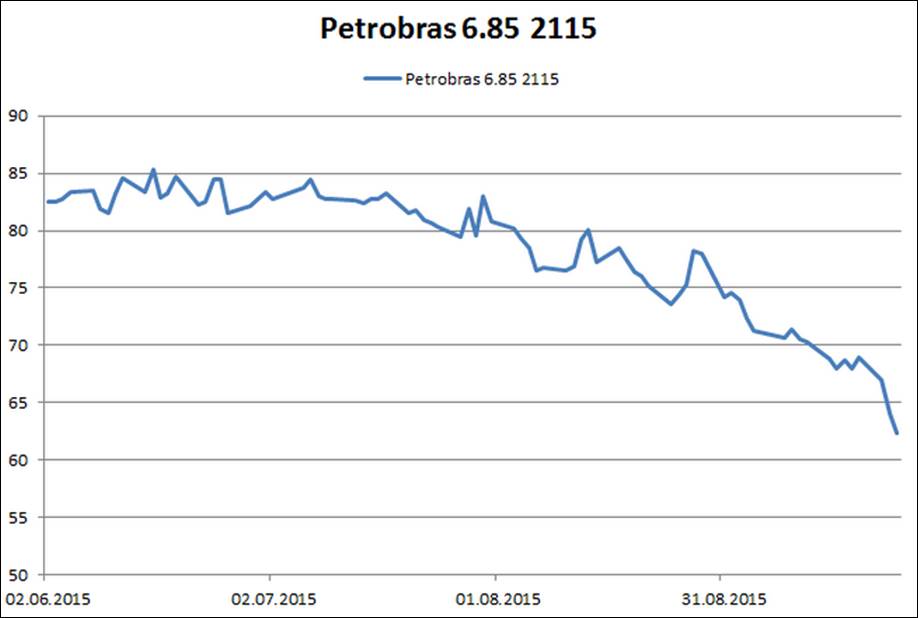

That’s the unwinding of the oil carry. It goes way beyond oil-related items as it affects the very solvency of the country. The same happened – are will continue to do so – to oil companies.

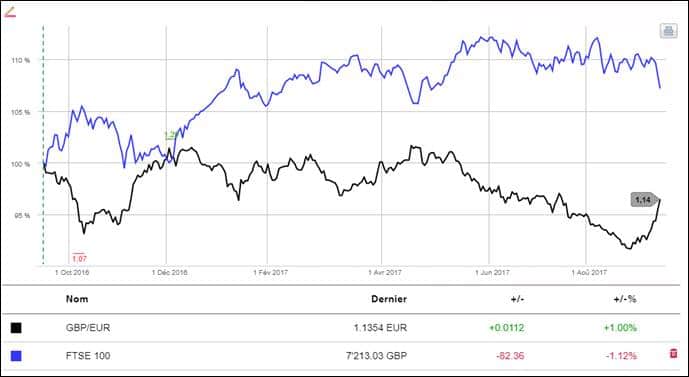

Oil prices remain the most important driver of the current credit dynamics. Recall that this downgrade happens while oil prices declined by more than 10% on a YTD basis:

“RATING SENSITIVITIESThe following factors, individually or collectively, could trigger negative rating action:Continued rapid erosion of the fiscal or external positions, for example as a result of a failure to implement fiscal reforms or due to a renewed fall in oil prices.Spillover from regional conflicts or a domestic political shock that threatens stability or affects key economic activities.” |

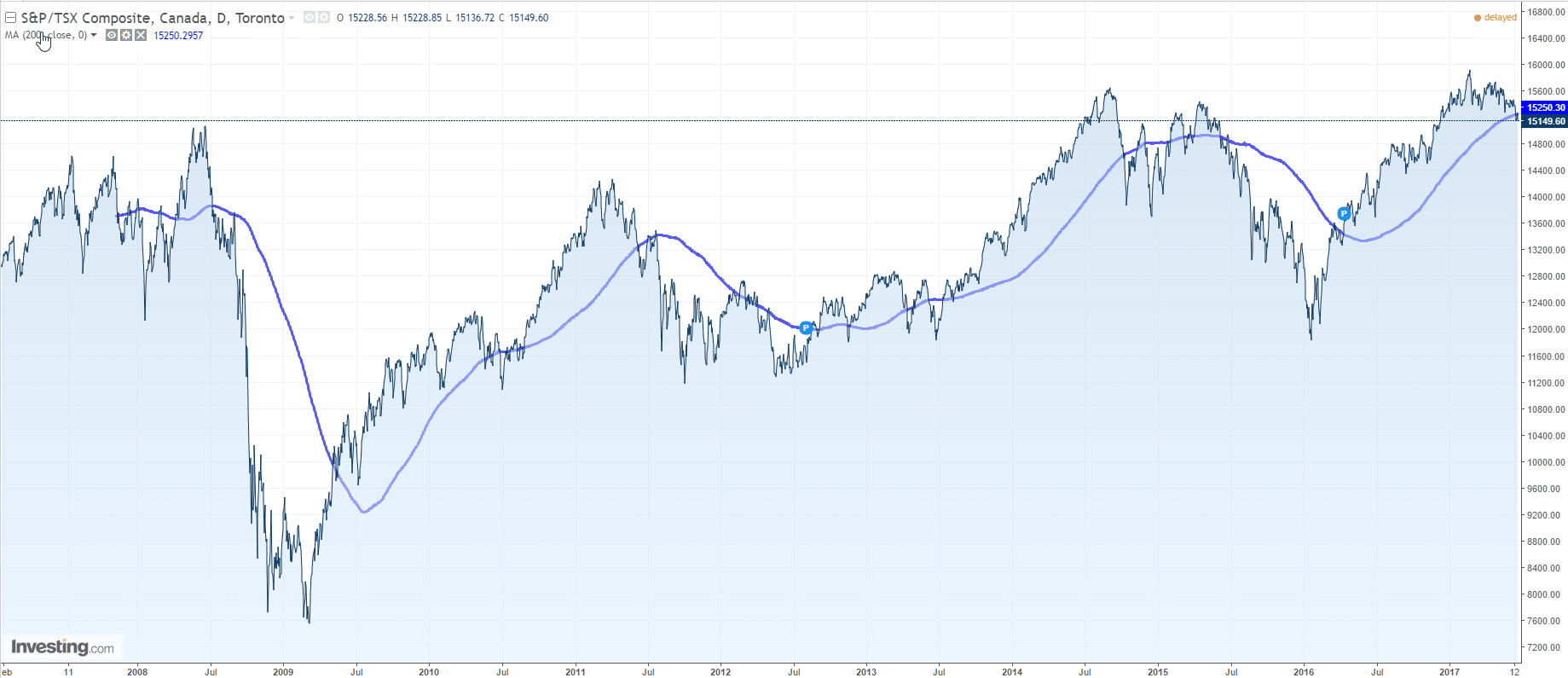

Oil has been a key driver behind the 2015 and early 2016 macro-market dislocation. Since then price expectations have been adjusted along what we see as a temporary relief :

“KEY ASSUMPTIONSFitch forecasts Brent crude oil prices to average USD52.5/b in 2017 and USD55/b in 2018.” |

We suggest:

- The reflationary trade has much more to do with oil than growth, investments or core inflation

- The difference between current and expected oil prices might be a valid indicator of our credit repricing scenario

- We relate the downtrend in oil prices to a slow-motion, long lasting macro-financial deleveraging process. It is not over.

- The fate of the oil carry, more precisely the dynamics of the above deleveraging, depends on growth and public promises.

We wouldn’t bet too much on the latter.

With kind regards,

Jacques