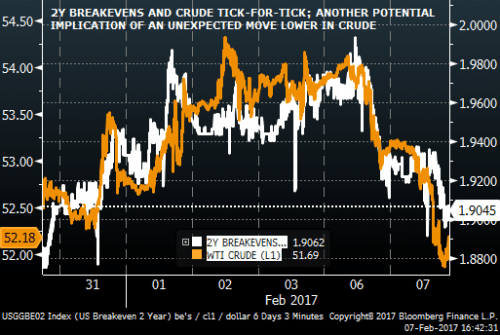

Let us dig into oil, inflation expectations and interest rates.

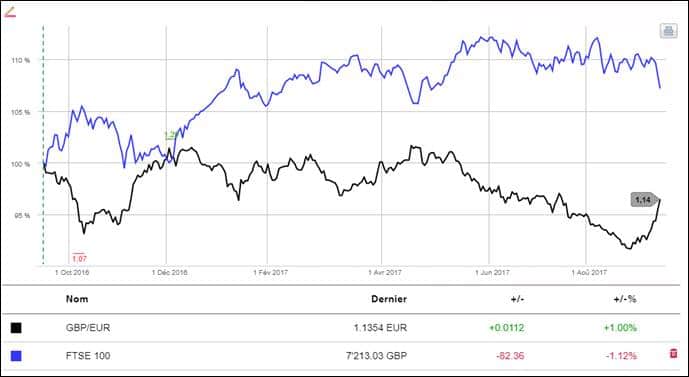

The latest developments look like a material pause in the current ‘reflationary trade’ …

Source: ZH

… maybe because growth expectations are facing some sort of reality check:

Source: ZH

As a reminder we think that the current overshoot of growth expectations is a combination of ‘fiscal forward guidance’, public appeal and rising oil prices, which mean temporarily rising trade figures.

As the chart above may indicate however, we expect oil reflation to conflict with fading economic forces.

Let’s come back to the ‘credit risk repricing scenario’ which we oppose to the post-election ‘reflationary trade’.

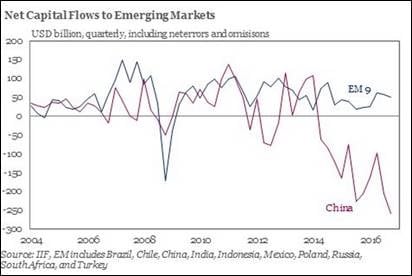

The current slowdown in China is adding further pressure onto the global economy. By all means, we consider it as a powerful deleveraging process that FX reserves and capital flows enable to illustrate.

Please consider the following charts from ‘Equity Markets Shift From Risk-on/off to Trump-on/off’ by the SoberLook / the WSJ Daily Shot:

Source: The WSJ Daily Shot

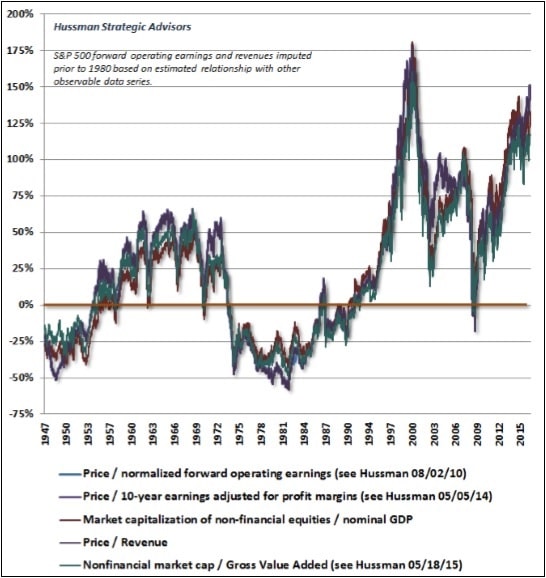

And last but not least, as the ‘reflationary trade’ looks overstretched, please take a look at this valuation chart by John Hussman :

Source: Hussman Strategic Advisors, Weekly Market Comment, 01.30.2017

His comments are always insightful :

“On the basis of capitalization-weighted indices, historically-reliable valuation measures now approach those observed at the 2000 bubble peak. Yet even this comparison overlooks the fact that in 2000, the overvaluation featured a subset of very large-capitalization stocks that were breathtakingly overvalued, while most stocks were more reasonably valued (see Sizing Up the Bubble for details). In many ways, the current speculative episode is worse, because it has extended to virtually all risk-assets.” |

With kind regards,

Jacques