Yet another emerging tantrum …

James Mackintosh makes a nice parallel in the the Wall Street Journal between the ‘taper tantrum’ of 2013 and the current ‘emerging tantrum’.

We suggest that the effects of the current rise in interest rates, while perceived as a positive for growth and reflation, will backfire on trade.

Please consider ‘America First? That Puts Emerging Market Last’.

Mackintosh draws parallels and differences between the 2013 ‘taper tantrum’ and today’s situation.

Starting with the parallels:

(emphasis ours)

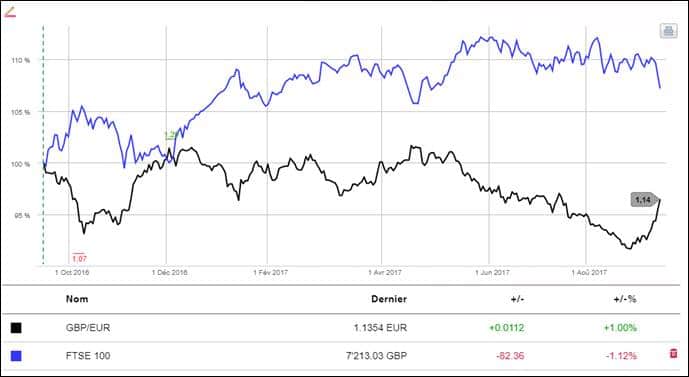

| “There are some clear parallels. When the Fed indicated in 2013 that it would pull back from bond buying, it led to panic selling of emerging-market bonds. Investors had piled in as part of the global hunt for yield, and as the fast money left yields soared and currencies fell. The yield on the J.P. Morgan local-currency bond index leapt by 2 percentage points from the low of 5.19% reached in May 2013.

Something similar has happened this time. A month before the election, emerging market local-currency bonds, the riskiest type, had just had their best eight-month period since the financial crisis ended in 2009, returning more than 20%. Since then, the combination of tumbling currencies and rising yields means investors have lost 8%, almost all since Election Day.” |

And the differences:

| “Rather than being driven by a change in the Fed’s approach, as in 2013, this time the problem for emerging markets is the expectation of more growth and inflation in the U.S. from Mr. Trump’s promised tax cuts and infrastructure spending. In principle, faster U.S. growth ought to mean bigger emerging-market exports to help offset higher financing costs, particularly as the Fed will still be setting rates far below inflation, even after next month’s likely increase.” |

And the main proposition:

| “Here is where Mr. Trump’s trade threat makes a bad situation worse. While a trade war would hurt growth everywhere, including the U.S., Mexico and China are first in the line of fire. The Mexican peso has plunged 11% since the election, and the yuan up to Friday had its second-worst eight-day period against the dollar in the past two decades (the worst was last summer’s devaluation). Investors in the developed world are shrugging off the threat of a trade war, but it is being at least partly priced in for emerging markets.” |

… as a direct consequence of vehement social unrests

Mackintosh concludes:

| “A big emerging-market rally would be certain if Mr. Trump backed away from his trade rhetoric, but offering to put America somewhere in the middle of the pack wouldn’t cut it with Mr. Trump’s supporters.” |

Spot-on: a different trade rhetoric or a swift yield management could trigger an emerging market rally.

As social unrests materialize however, and central banks continue to exit, we believe that such an outcome looks overoptimistic.

Expect more as cheap public policies backfire

We suggest:

- The current emerging tantrum is related to rising yields and tighter financial conditions

- It coincides with a transition phase of public policy in which central banks are forced to exit while fiscal policy kicks in a disorderly manner

- The markets seem to expect a painless emerging tantrum in terms of growth/inflation.

These expectations are too complacent. We think that emerging markets will backfire as trade fails to recover.

More on growth and policy transition in our next posts.

Jacques