A brief update of our latest posts about oil supply, credit and Canadian real Estate.

The rating agency Moody’s downgraded the long-term ratings of six Canadian Banks yesterday “reflecting Moody’s expectation of a more challenging operating environment for banks in Canada for the remainder of 2017 and beyond, that could lead to a deterioration in the banks’ asset quality, and increase their sensitivity to external shocks.”

As Bloomberg points out, citing David Beattie of Moody’s, the debt burden of Canadian consumers as well as elevated housing prices “leaves consumers, and Canadian banks, more vulnerable to downside risks facing the Canadian economy than in the past”.

Please consider ‘Six Canadian Banks Cut by Moody’s on Consumers’ Debt Burden‘ by Bloomberg:

(emphasis ours)

| A run on deposits at alternative mortgage lender Home Capital Group Inc. has sparked concern over a broader slowdown in the nation’s real estate market, at a time when Canadians are taking on higher levels of household debt. The firm’s struggles have taken a toll on Canada’s biggest financial institutions, which have seen stocks slide on concern about contagion. |

| In its statement, Moody’s pointed to ballooning private-sector debt that amounted to 185 percent of Canada’s gross domestic product at the end of last year. House prices have climbed despite efforts by policy makers, it said. And business credit has grown as well. |

| “We do note that the Canadian banks maintain strong buffers in terms of capital and liquidity,” Moody’s said. “However, the resilience of household balance sheets, and consequently bank portfolios, to a serious economic downturn has not been tested at these levels of private sector indebtedness.” |

Contagion, the expression seems appropriate given the multi-sigma event of HCG.

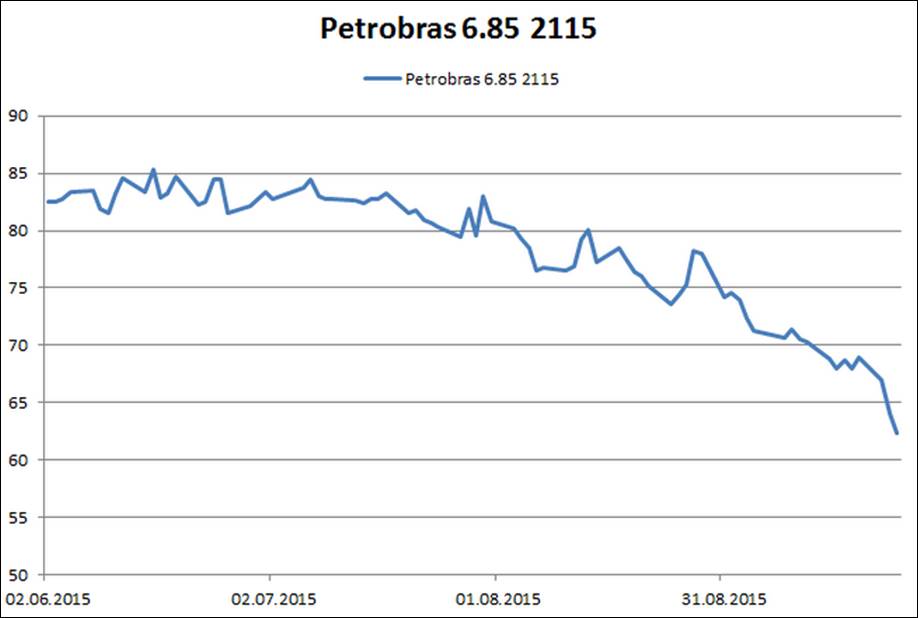

Yet we believe that the real contagion agent is of a slightly different nature, namely oil and commodity prices.

Again, it is striking to see how quickly rating agencies react after significant drops in oil prices.

Stay tuned, assuredly more to comme.

Jacques