The latest Global PMI indicators of JPMorgan give an insightful picture about

- the fading momentum of US and UK growth expectations and

- the lagging pattern of European ones.

Please consider ‘Global economy hits speed bump, PMI dips from 22-month high’ by HIS Markit.

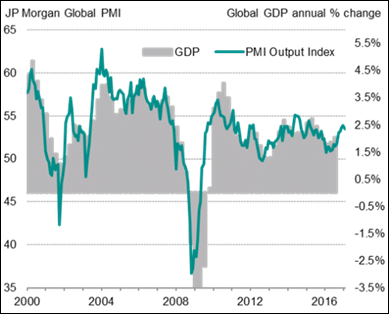

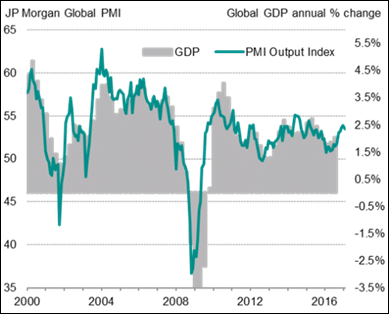

To start with, note the declining trend of the Global PMI indicator since the financial crisis, as well as the latest bump that inspired Markit’s title.

Unfortunately, we believe it’s more than a bump.

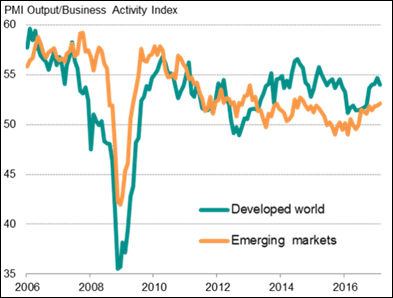

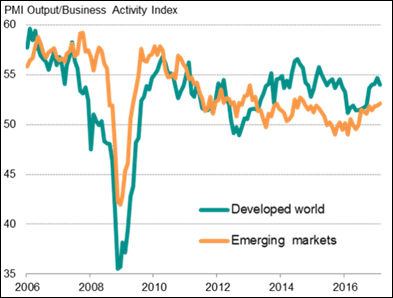

At the same time, Emerging markets (for once) and Europe (as usual) are lagging the US :

Markit comments: ‘Eurozone leads the developed world expansion’.

We believe it’s way too optimistic: if the US fails to drive global growth, where would the European lead come from ?

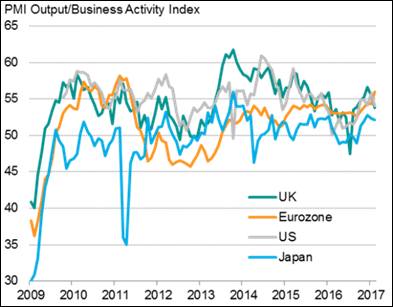

“Eurozone leads developed world expansion

• Developed world growth was led by the eurozone, where growth hit a near six-year high. Growth meanwhile slowed in the US, UK and Japan, albeit remaining robust in all cases by recent standards to suggest broad-based expansions among the four largest rich-world economies.

• Russia continued to lead the emerging market upturn, recording the highest PMI of the BRIC nations for the fourth successive month. Growth accelerated in China, and India returned to expansion for the first time since October, suggesting the economy is recovering from the disruptions of demonetisation.

• Brazil remained firmly in decline, though the contraction was the shallowest for almost two years.”

|

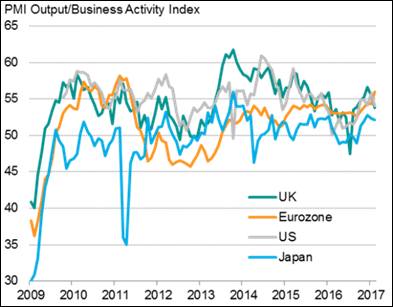

We suggest: Eurozone lags the US decline …

“US surveys point to strong Q1 but hint at business mood cooling

• The US PMI surveys suggest the economy is growing at an annualised rate of around 2.5% in Q1. It remains unclear whether a February slowdown merely represents some pay-back after a strong start to the year, or whether it’s the start of a more entrenched slowdown. A clue rests with the business expectations index, which indicates that business optimism has mellowed back to its post-election level, suggesting companies are becoming more cautious with regard to spending.

• Companies nevertheless continued to report buoyant domestic demand and continued to take on staff in reasonable numbers, the rate of hiring having slowed only modestly. The February survey is broadly consistent with 175,000 payroll jobs being added, which represents a pace of hiring that will do little to deter the Fed from delaying its next rate hike.”

|

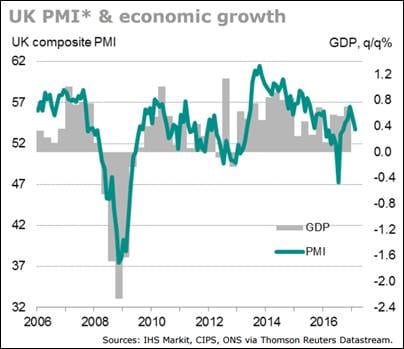

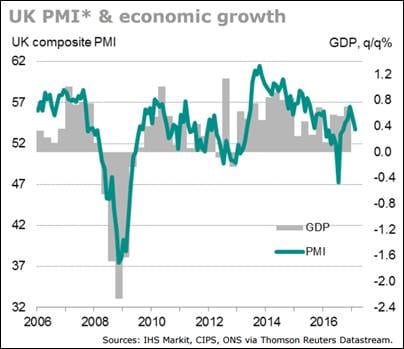

… and the end of the post Brexit magic :

“UK PMI indicates slowdown in GDP growth to 0.4% in Q1

• The Markit/CIPS ‘all-sector’ PMI fell for a second successive month in February, dropping to a five-month low of 53.7 from 55.1 in January. The readings for the first two months of the year so far suggest the economy will grow 0.4% in Q1, markedly lower than the 0.7% expansion seen in Q4 of last year. The slowdown signalled by the February surveys pushes the PMI back towards territory more indicative of additional policy stimulus from the Bank of England than a tightening.

• However, inflationary pressures remained the highest for six years as firms struggled with rising costs associated with the weak pound. The steep upturn in costs suggests that consumer price inflation has significantly further to rise from the 1.8% annual rate of increase seen in January.”

|

The combination of declining leading indicators and rising inflation expectations could make the much awaited monetary normalization somewhat more disruptive.

We suggest to focus on the yield curve dynamics, more to come.

Jacques

A blog about finance

Hi Jacques,

Thanks for the post. Economic AND inflation surprise indicators in positive territory for most regions… a rare combination over the past 10 years. As for now we are certainly feeling some sort of fatigue despite the latest signs of economic improvement. With best regards, Sébastien

Thank you for your comment Sébastien.

You’re right, inflation and economic expectations are on the rise and the bump might be temporary. As I read it you’re on the reflationary side. As discussed here let me challenge some of its rationale.

I see the recent reflationary trade as mix of oil rebound, improvements in global trade, a managed credit landing in China, aggressive fiscal guidance and buoyant animal spirits. I do not see these factors as an economic inflexion point however but a temporary relief. I believe it will struggle to counter much stronger deleveraging forces, i.e. a normalization of macro-credit (see here for instance for an illustration of oil as a credit variable).

I would put the legacy of excessive monetary policy on the top of this agenda to get an alternative reading of your reflationary trade: a credit risk repricing.

More to come about the impact of this scenario on the yield curve, happy to share.

Best regards,

Jacques

Very interesting in deed.

All this comes at the same moment where equity markets are stretched, 10Y Us Treasury are toping its secular bull market trend (2.6%), gold topped at $1265.- (200 MA), oil prices fell and found ground at $48.68 (200 MA).

This afternoon (Employment figures in the US) and the FOMC on Wednesday will be the major triggers for the next markets’ dynamic.

We qualify this precise situation as a “Pivotal Point”.

Best Regards,

David

Thank you for sharing David,

Looks like one of these ‘market-macro’ crossroads …

On the top of the yield curve, on should probably look at volatility.

Best regards,

Jacques

In deed.

Volatility, measured by the VIX index, is trading between 11 and 12 points’ level which is to be considered as very low !!!

Buy volatility !!!