Oil prices deserve a special attention in the aftermath of the US election.

Connecting the dots, we believe that they help explain some of the recent trends in the markets.

This post explores the financials of interest rates and oil.

The oil carry

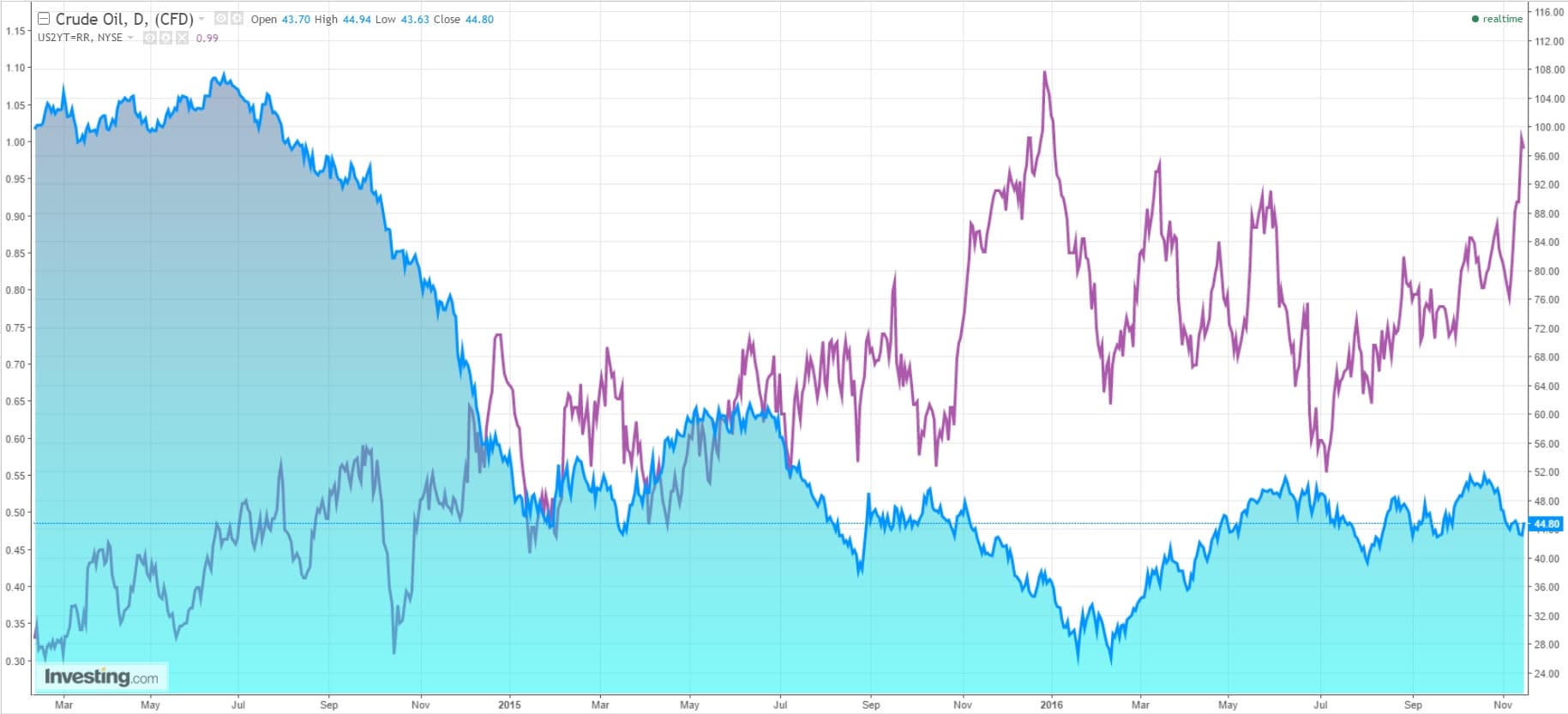

As a reminder, oil prices experienced a spectacular 75% drop between mid-14 and January 2016. Since then, they rebounded another 75%.

As we all remember however, ‘minus 75% plus 75%’ does not equal 0 in this brave compounding world:

A sticky deleveraging process

Prior to digging into the current state of affairs, here’s a recap of our previous suggestions :

- The early decline of oil prices triggered a negative circle, which we described as the unwinding of the oil carry, a classical deleveraging process.

- Some companies had no other choice but to produce at cost as a cheap way to remain solvent, i.e. to service the (mountain of) debt sponsored by unconventional market conditions.

- The deleveraging process is sticky, long-lasting and far from over. Even at 50 USD/barrel, companies may have troubles to service their debt. Expect oversupply to unfold.

- Banks have played an important role in supporting oil companies, in an attempt to tame their own (bad) loan woes.

- As we figure out in a financial carry mechanism, oil prices, interest rates and the fate of investment banks are tightly connected.

Persistent oversupply, declining demand

A combination of lower growth in emerging markets (demand), lower oil prices and higher rates triggered an unwinding spiral that led to the current level of prices and oversupply.

Is it over for now? Are rising interest rates the answer?

The markets seem to have a clear take, we are less convinced.

See our propositions below.

Source: investing.com

We suggest:

- Rising interest rates are a reflexion of the fading grip that central banks have exerted on the yield curves.

- We suggest it is coherent with a reassessment of credit risk …

- … that has nothing to do with better economic conditions.

- Oil prices have rebounded since January as central banks tried to improve liquidity and financial conditions via ‘lower for longer’ interest rates.

- This in turn, as suggested by various leading indicators, triggered a timid improvement of trade. As for other commodities, some see it as a proof of a growth revival.

- Even if this scenario is engaging, we fail to see it : higher interest rates should put further pressure onto the oil carry…

- … and extend the underlying, real normalization trend, which remains in force.

- The unwinding of the oil carry could take different faces: lower oil prices (chart above), oversupply, corporate activity, renewed banking pressures …

Jacques