Various European climax indicators have been published recently.

They look like a distant remake of an economic movie made of market expectations, growth, policy and politics.

Again, two scenarios are available: make your mind !

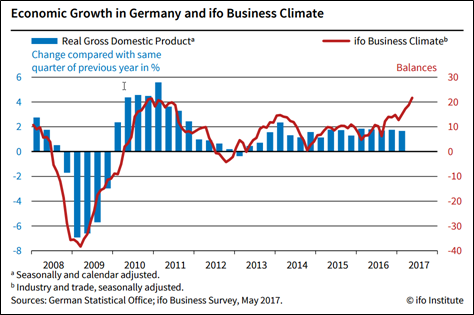

The German ifo Climate Index reached an all-time high leve in May:

Source: cesifo Group Munich

| The mood among German business was euphoric in May. The ifo Business Climate Index rose from 113.0 1 points last month to 114.6 points, the highest figure on record since 1991. Companies upwardly revised assessments of both their current business situation and their business expectations significantly. This development in the ifo index combined with other key economic indicators, points to economic growth of 0.6 percent in the second quarter. Economic activity in Germany remains very brisk. |

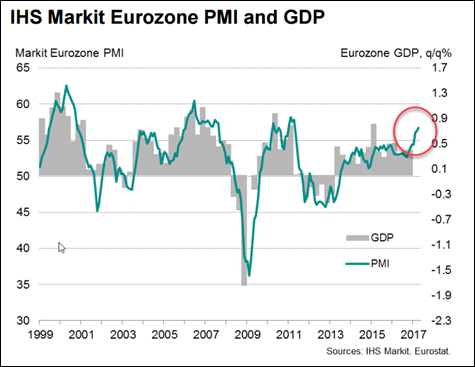

At the same time, the IHS Markit Eurozone flash PMI got turbo-charged to a six-year high, 56.8 mark:

£

£

Source: IHS Markit

The PMI data indicate that eurozone growth remained impressively strong in May. Business activity is expanding at its fastest rate for six years so far in the second quarter, consistent with 0.6- 0.7% GDP growth. The consensus forecast of 0.4% second quarter growth could well prove overly pessimistic if the PMI holds its elevated level in June. |

Overly pessimistic?

For sure if one reads ‘The threat of an overheated German Economy‘ by Credit Writedowns Pro:

The Eurozone economy is doing really well. Some data points to 3% growth. The German economy is doing even better – with some data pointing to 5% annualized growth. But there’s a downside – overheating. … At the same time, in Germany, the second estimate for first quarter growth confirmed the initial 0.6% number. And private consumption is the underlying driver, as it has been since 2014, contributing about one half of GDP growth in that three year period. On the back of these results, business confidence in Germany is so high now that it corresponds to an annualized 5% GDP growth print. |

Source: www.pro.creditwritedowns.com

| The threat is overheating in Germany. We saw this last decade when the eurozone core was less robust, but periphery countries like Ireland and Spain were benefitting from free capital movement in the single currency zone and low interest rates. Spain and Ireland overheated with massive property bubbles ending in tears, transforming the countries from fiscal paragons to bailout basket cases. The German central bank is warning that the same thing could be happening right now in Germany. … Therefore, the Goldilocks scenario would be a long enough period of eurozone growth without German overheating to make the necessary changes to the EU before a recession hits. Time will tell if this is even possible. |

Remember the US soft-hard debate? Time to re-read it on the other side of the Atlantic.

Some propositions along the previous lines of our macro-financial framework:

- As the US demonstrated in Q1, expectations do not always translate into real data.

There are limits to forward guidance, be it related to monetary, fiscal or even oil policy. More to come in a next post. - Europe, Germany in particular, enjoyed a steaming period of trade recovery, i.e. higher oil prices, lower euro and rising economic expectations topped by early signs of political normalization.

-

All of the above comes with a lag however:

- The decline of oil prices has been dependent on public agreements that prove difficult to satisfy

- The euro has been recovering of late as the US fills the soft-hard gap

- The normalization of social unrests and populism, while definitely a positive, will soon land into economic reality.

The Eurozone economic cycle is lagging the US one.

Where will the European impetus come from once the soft-hard reconnect reaches Europe ?

Mind the gap …

With kind regards,

Jacques