Growth expectations down, interest rates up: the latest PMI figures and bond market developments seem to fit into our systemic convergence scenario.

IHS Markit indices were published hours before very interesting moves happened in the bond markets. The bund overshoot by 8 basis points yesterday, while the BOJ had to intervene aggressively to keep its 10Y JGB below +0,1%. As a reminder, that is well above the 0% target of the BOJ’s comprehensive assessment.

See our propositions at the end of this post: we argue for some time that monetary normalisation is a global process that sanctions and reprices excessive credit. Ironically, the latter has been engineered by public authorities and central banks themselves. Even if growth is fading, central banks are now forced to reverse course as risks of financial stability are mounting. We called this process ‘systemic convergence’.

Please consider the latest UK services PMI by IHS Markit: “Slower rise in service sector activity”.

‘Slower rise’ is a soft wording for describing the current state of affairs :

Source: IHS Markit

Meanwhile in Europe, five months after their US counterparts, European leading indicators seem to show first signs of weakness. Markit had another nice wording for it: “Eurozone economic growth at six-year high during second quarter”.

Please take a closer look at the recent momentum of the PMI series :

Source: IHS Markit

Just a blip?

Unfortunately not, please do not forget to ‘Mind the gap’ …

Why do the major world economies fail to ignite after so many years of sustained public policies ?

We’ve got some propositions below. But beforehand, take a look at the latest PMI in China.

Again from IHS Markit: ‘Chinese business activity expands at slowest rate for a year’ :

Source: IHS Markit

The landing of the Chinese economy pictured above is part of a hidden but awfully strong economic process. It’s called credit unwinding or, if you prefer, normalisation.

Almost at the same time, the parallel is striking, the ECB released its latest minutes.

Please consider: “ECB officials warned of adverse market moves at June meeting” from the Financial Times:

The minutes reveal the ECB’s members thought “it was necessary to avoid signals that could trigger a premature tightening of financial conditions” that might undo recent progress on inflation. |

“Very adverse scenarios for the inflation outlook had become less likely, in particular as deflation risks had largely vanished,” said the minutes. |

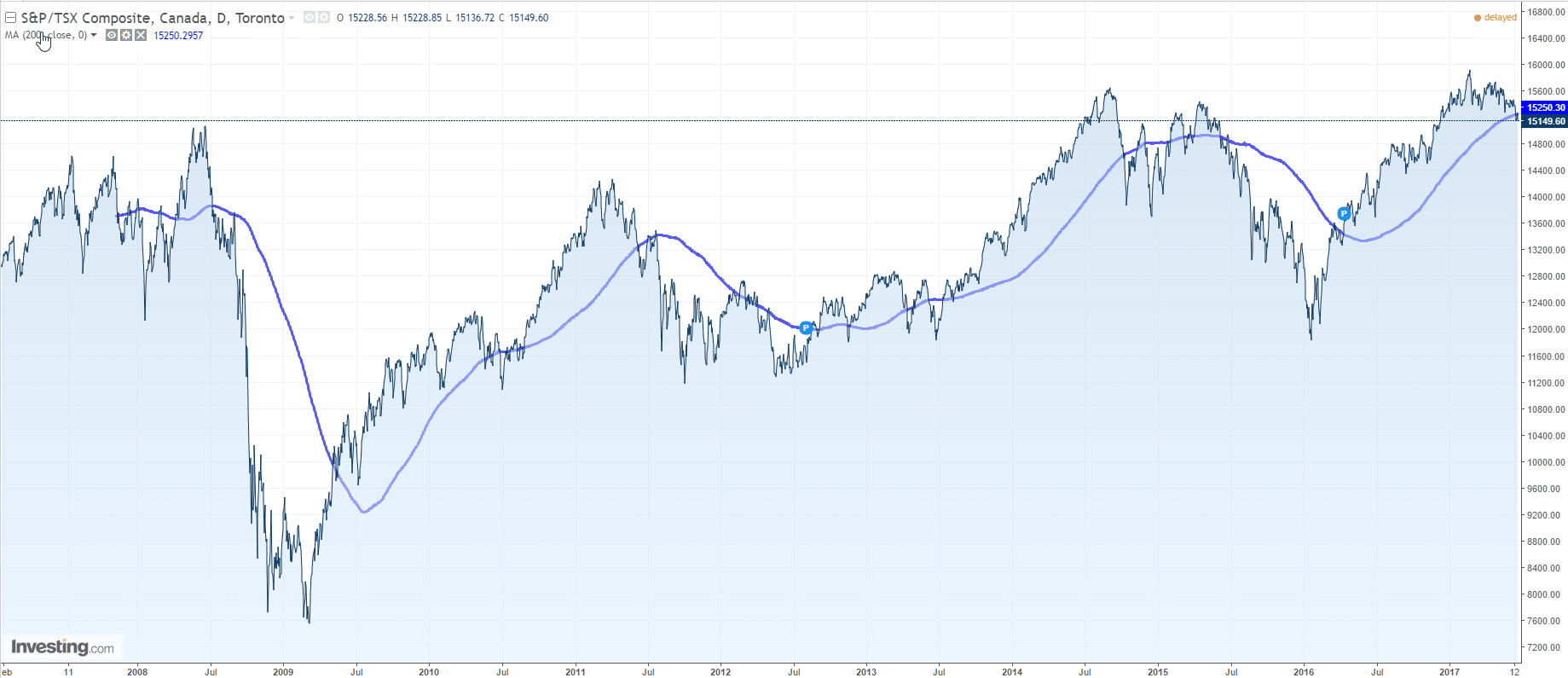

The minutes triggered one of those “convergence moves” that fuelled some previous tapering expectations:

Source: investing.com

We suggest:

- European growth expectations start to reverse. Europe is not leading the world economy, it is lagging the US.

- Precisely, given the time structure between the US and the European economic cycle, we would expect this reversal to expand. More to come.

- Excessive credit is unwiding in China. This is by far the most significant financial and real ‘normalisation’ force at play.

- Monetary normalisation, as pictured above, is just the visible part of it. We see this as a global, synchronised process.

- It is about to continue.

Yes, interest rates can increase while growth expectations decrease.

As unorthodox as it looks, this happens when excessive economic policies lead to severe financial stability issues.

With kind regards,

Jacques