Nowcasts, a contraction of current economic conditions (now) and forecasts, have been attracting a lot of attention of late.

Indeed they give further insights into the ‘valuation gap’ that may exist between climax/sentiment indicators and actual economic conditions, a topic covered here or here.

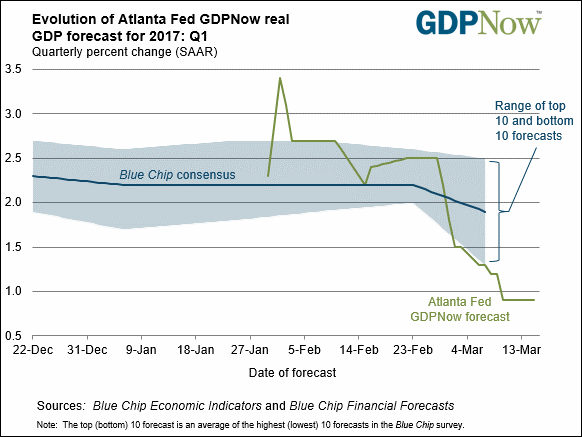

Please consider the very latest GDPNow release by the Federal Reserve of Atlanta:

From the Fed of Atlanta’s site:

“Latest forecast: 0.9 percent — March 15, 2017 The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2017 is 0.9 percent on March 15, down from 1.2 percent on March 8. The GDP growth forecast declined 0.3 percentage points on Friday when the February estimate of the model’s latent dynamic factor used to forecast yet-to-be released GDP source data declined after the employment situation release from the U.S. Bureau of Labor Statistics (BLS). The forecast for first-quarter real consumer spending growth inched down from 1.6 percent to 1.5 percent after this morning’s retail sales report from the U.S. Census Bureau and the Consumer Price Index release from the BLS.” |

What next? Is it about to influence the much awaited stance of the Fed ?

Zero Hedge gives a rather ironic reading :

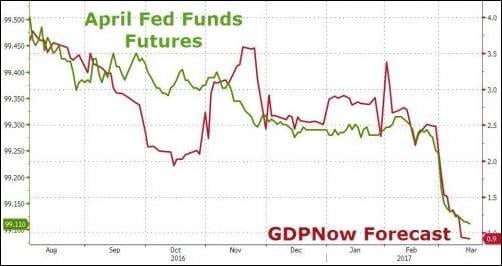

“While it may not be the very definition of irony, we do find the fact that the Atlanta Fed has just cut its Q1 GDP forecast from 1.2% to 0.9%, a number which if confirmed would be the lowest quarterly print in year, just two hours before the Fed’s rate hike quite humorous. As a reminder, the number was as high as 3.4% one and a half months ago. The chart below reveals that the worse the economy was doing, the higher the odds of a rate hike.” |

We suggest: there is no contradiction in hiking rates while growth is slowing, provided that financial stability is at stake.

Jacques

Let me briefly comment the following e-mail exchange. It reconnects the soft vs hard data debate to the assumption of ‘systemic convergence’. The latter states that central banks are / will be forced to normalize their (unconventional) policies independently of real economic conditions. Yet it obviously helps if real data is supportive, or at least expected to be so. That’s the reason why, I believe, the Fed rushed in guiding the March hike.

Q:

I do not understand the last sentence of your post: We suggest: there is no contradiction in hiking rates while growth is slowing, provided that financial stability is at stake.

Is there a ‘not’ missing, or am I missing it ?

A:

I hope my English did not betray me…

Let’s find out.

This post is about systemic convergence: the assumption that central banks are (or will be) forced to normalize their unconventional monetary policy in order to avoid systemic or financial stability risks.

Think of banks, insurances, pension schemes, asset valuation, etc … If rates stay too low for too long – which I believe has already been the case – monetary policy is more a problem than a solution. To take Bernanke’s words: the cost/benefit ratio of unconventional monetary policy turns negative.

Back to the post. The Fed has been driving the short end of the curve quite aggressively of late: in a matter of weeks, the probability of a March hike went from less that 50% to 100%. Why such a hurry? Is growth or inflation exploding ? I doubt that. My best guess would be that the Fed is making use of the Trump effect – i.e. a fierce set of growth and inflation expectations – as a way to ‘finance’ its normalization.

To figure out, one should focus on the gap between expectations and current economic conditions. That’s precisely what the GDPNow model is supposed to do :

1. If the model is valid – and I believe it is – then the Fed should not be in a hurry to hike rates. In other words: a rate hike would be contradictory (your understanding I guess) ;

2. but if QEternity puts financial stability at risk, then the benefits of a hike would dominate the cost of a status quo (my reading).

Of course, the GDPNow model can be misleading. Interestingly enough however, the decision of the Fed yesterday was felt as a ‘dovish hike’.

Best regards,

Jacques