The latest decision of the Fed is described as THE turning point of the US zero interest rate policy. Mission accomplished?

Not really. We suggest:

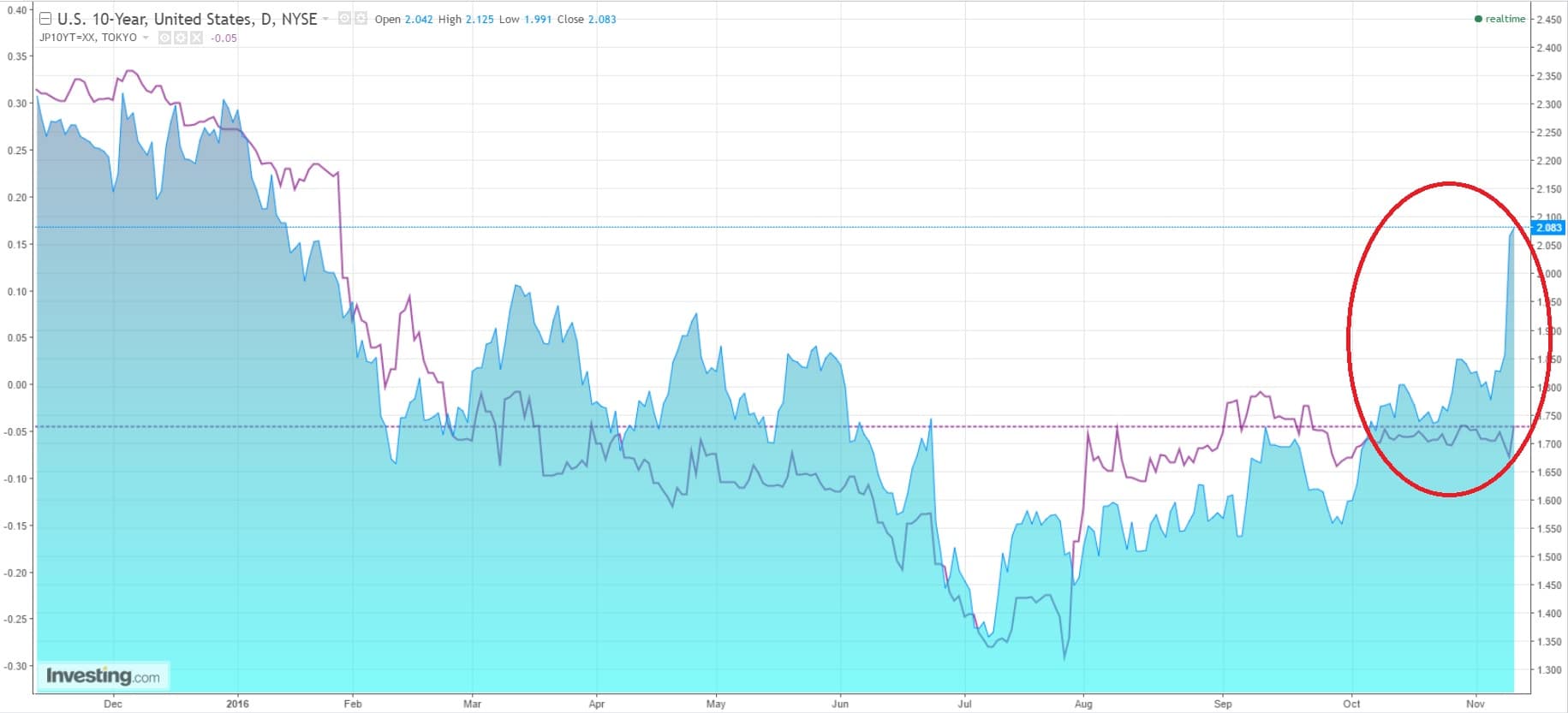

- The normalization of US interest rates started earlier 2013 with the taper tantrum. The ‘taper’ stands for the steady increase in short term interest rates that took place from there, while the tantrum stands for the contagion effects and market dislocations raised by the taper;

- Forward guidance has been used as powerful policy tool to fix the tantrum issue ;

- We believe that the Fed has been relying on this tool on Wednesday to generate a ‘dovish hike’;

- If we leave debatable employment data aside, there was no immediate fundamental reason to hike. Indeed, the risk of a policy mistake remains important;

- The main reason behind the move was, in our view, related to financial stability and systemic risk;

- We think that a gap exists between market expectations, partly based on the current policy divergences, and the systemic, structural path described above;

- It will be difficult to escape the normalization forces that are currently at play;

- We expect this disconnect to materialize in the forward guidance area.

Several papers help underline the core proposition of this note: financial stability concerns stood behind the latest Fed decision.

In “Fed rate rise is first step to rebalance US financial system”, FT’s Gillian Tett recalls the warning signs given by the BIS and the Office of Financial Research, a body created after the financial crisis to assess financial stability. She sees 3 risks worth considering: credit bubbles, investors’ risk attitude and money market flows:

These three points are not the only challenges in markets. Nor do they mean the Fed is wrong to raise rates now. On the contrary, the distortions have arisen precisely because money has been artificially cheap for so long. A rate rise was long overdue — at least for the financial world. |

John Authers goes along the same lines in “Yellen discipline avoid market tantrum”:

Her task this week was to inculcate some discipline, by gently raising rates to head off what looks like the beginning of inflationary pressure in the US, without triggering a market spasm that would endanger financial stability and the economy. As a challenge, it can be likened to removing an iPad from a child’s grip without a meltdown.She achieved it. We have the first Fed rate rise in almost a decade, executed at a time when many significant voices were arguing against it, and the market response was negligible. The Fed’s message in advance had been clear, the market heard what it had expected, and as a result little happened. |

Really? Authers already point to a new malaise: the disconnect between market expectations and the path of the Fed’s guidance:

And it is not at all clear that the markets and the Fed understand each other, even now. Ms Yellen’s message was, in fact, a little firmer than markets had implicitly expected. That has yet to sink in.Most importantly, there is the vexed issue of the dot plot — the graphic that the Fed publishes every quarter showing each FOMC member’s estimate of the future path for the Fed Funds rate as a dot. Several governors did cut their estimate of how fast rates will accelerate from here. But the bottom line remains: their median estimate is for four rate hikes next year, bringing rates to 1.5 per cent. Yet the Fed Funds futures market, which investors use to hedge rate rises, barely sees any chance of the Fed’s suggested four rate hikes, and is priced for no rate rise until June. That would be an exceptionally dovish tightening cycle, particularly as politics could well make it harder for the Fed to raise rates in the months before November’s US election. |

The NY Times addresses the same issue via “Janet Yellen New Hat: Risk Manager”:

One major risk is that the announcement will turn out to be a “Mission Accomplished” moment for the Fed. Maybe the struggling global economy will hold back the United States more than Ms. Yellen expects, inflation will remain well below the Fed’s 2 percent target, and it’ll have to reverse course, as have several global counterparts that have raised interest rates prematurely in the last few years. So one argument is that the Fed should have waited until inflation was more clearly rising before taking its foot off the accelerator of the United States economy. As the central bank’s chief risk manager, Ms. Yellen was persuaded by a different sort of danger. If the Fed had waited another several months, to the point where the economy was at real risk of overheating, with inflation rising significantly, it may have needed to increase rates sharply to try to head it off. And when moving quickly, there would surely be bigger disruptions to financial markets and greater risk of miscalibration and raising rates too much, choking off the economy altogether. “Such an abrupt tightening could increase the risk of pushing the economy into recession,” Ms. Yellen said Wednesday afternoon.. |

Let us recap our assumptions:

- Financial stability considerations, not so much economic efficacy or labor market achievements, were the driving force behind the Fed hike;

- Systemic problems have been gathering speed since the taper tantrum. So the need for a proper exit strategy. So the normalization. We are talking about the same logic;

- Forward guidance has been used as a powerful tool to reconcile market expectation and policy normalization. We believe it will be increasingly difficult to do so. More precisely: this is where we would expect policy normalization to take place;

- Various ‘systemic events’ highlight our assumption of stability convergence: the unpeg of the SNB, the Chinese turmoil, the ECB decision and, more recently the BoJ guidance, which both disappointed. Expect more to come;

- We see the avalanche of systemic recommendations by national and supranational bodies (BIS, IMF, OFR, FSB, …) as a further indication of the forces at play.

Best regards,

Jacques