Capital flows

Happy New Year !

Carmen Reinhart’s research about debt, capital flows and financial crises became popular after the publication of « This Time is Different : Eight Centuries of Financial Folly », the famous research book co-authored with Kenneth Rogoff.

Please consider ‘A Year of Sovereign Defaults?’, a contribution published recently in the Project Syndicate (French and Spanish translations are also available in the site).

Carmen Reinhart reviews the very long term pattern of sovereign credit defaults. She underlines long term cycles, which under the current economic conditions may trigger renewed tensions:

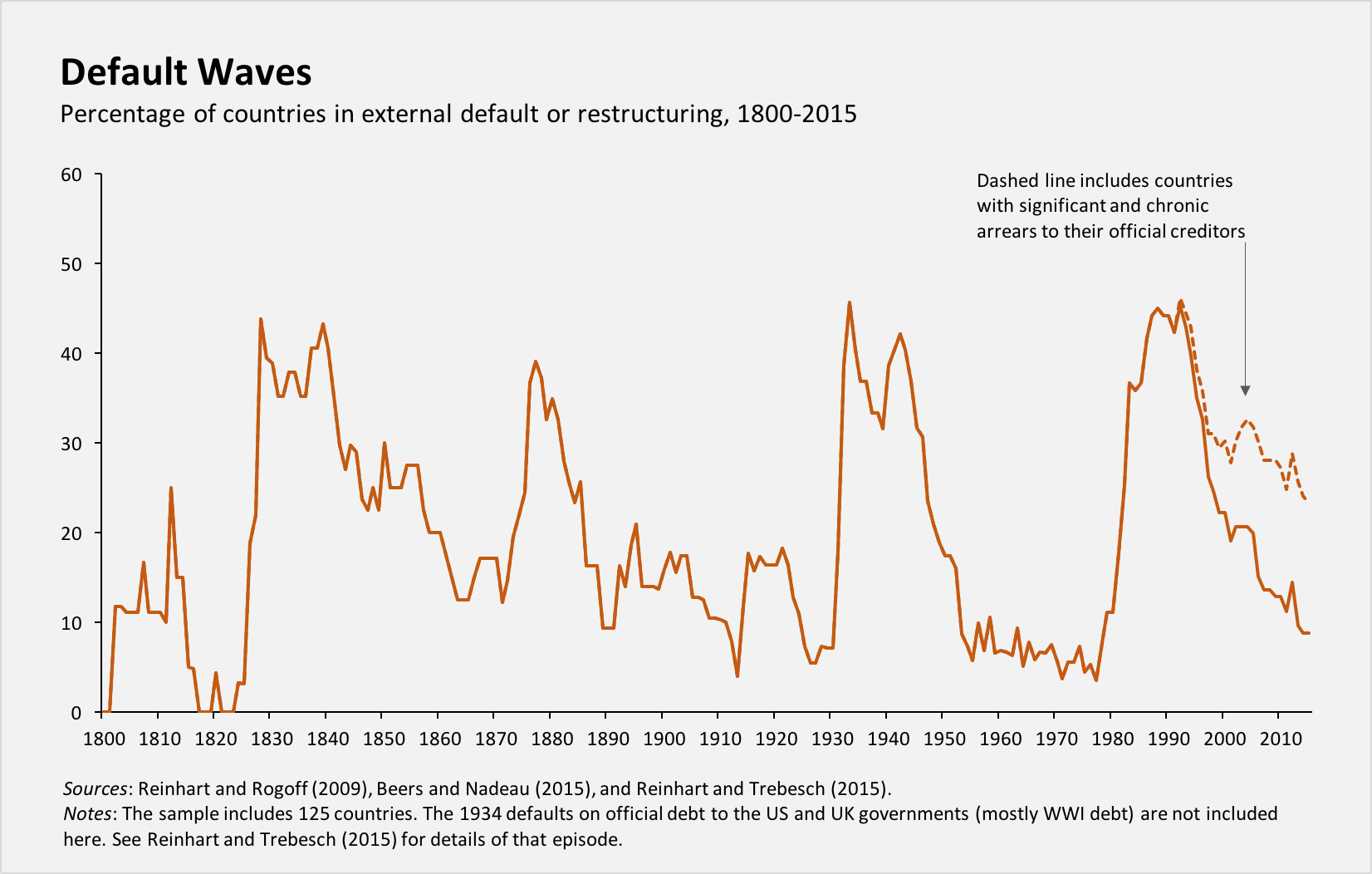

| Like so many other features of the global economy, debt accumulation and default tends to occur in cycles. Since 1800, the global economy has endured several such cycles, with the share of independent countries undergoing restructuring during any given year oscillating between zero and 50% (see figure). Whereas one‑ and two‑decade lulls in defaults are not uncommon, each quiet spell has invariably been followed by a new wave of defaults.

|

Very Interestingly she relates the evolution of the credit cycle to the pattern of international capital flows. The predictive power of peaks and troughs in international capital flows is of particular interest. According to a recent research, it enables her to predict sovereign debt/default stress ahead:

And, indeed, global economic conditions – such as commodity‑price fluctuations and changes in interest rates by major economic powers such as the United States or China – play a major role in precipitating sovereign‑debt crises. As my recent work with Vincent Reinhart and Christoph Trebesch reveals, peaks and troughs in the international capital flow cycle are especially dangerous, with defaults proliferating at the end of a capital inflow bonanza.As 2016 begins, there are clear signs of serious debt/default squalls on the horizon. We can already see the first white‑capped waves. |

Sovereign credit stress

Reinhart makes an overview of some the current sovereign distressed situations: Ukraine, Greece, Puerto Rico, the boom and bust pattern of emerging economies, the role of commodities and the example of Brazil. She concludes:

But the US Federal Reserve’s move to increase interest rates, together with slowing growth (and, in turn, investment) in China and collapsing oil and commodity prices, has brought the capital inflow bonanza to a halt. Lately, many emerging‑market currencies have slid sharply, increasing the cost of servicing external dollar debts. Export and public‑sector revenues have declined, giving way to widening current‑account and fiscal deficits. Growth and investment have slowed almost across the board. From a historical perspective, the emerging economies seem to be headed toward a major crisis. Of course, they may prove more resilient than their predecessors. But we shouldn’t count on it. |

More emerging tantrums

By putting the unwinding of zero interest rates policies, emerging markets, international capital flows, commodities, FX volatility and a lackluster global growth to the forefront, Carmen Reinhart’s arguments provide a strong background to some of our previous propositions:

- The Chinese turmoil of 2015 has a structural, systemic background

- The latter is related to the unwinding of credit, which in 2015 translated into an acceleration of capital outflows

- From a broader perspective, the Chinese turmoil was an episode of a long lasting, slow-motion normalisation process

- The Chinese turmoil, more precisely the fading of ‘the external model’ of emerging markets, is adding further pressure to the global economic conditions

- Capital flows played a major role in the Federal Reserve decision to adapt her policy / response function

- As a logical result of the normalization process, expect further volatility down the road, both in the real and financial spheres

- The unpeg of the SNB in January 2015 and the Chinese turmoil of July-August 2015 provide some evidence of this process

- Expect more to come.

Jacques