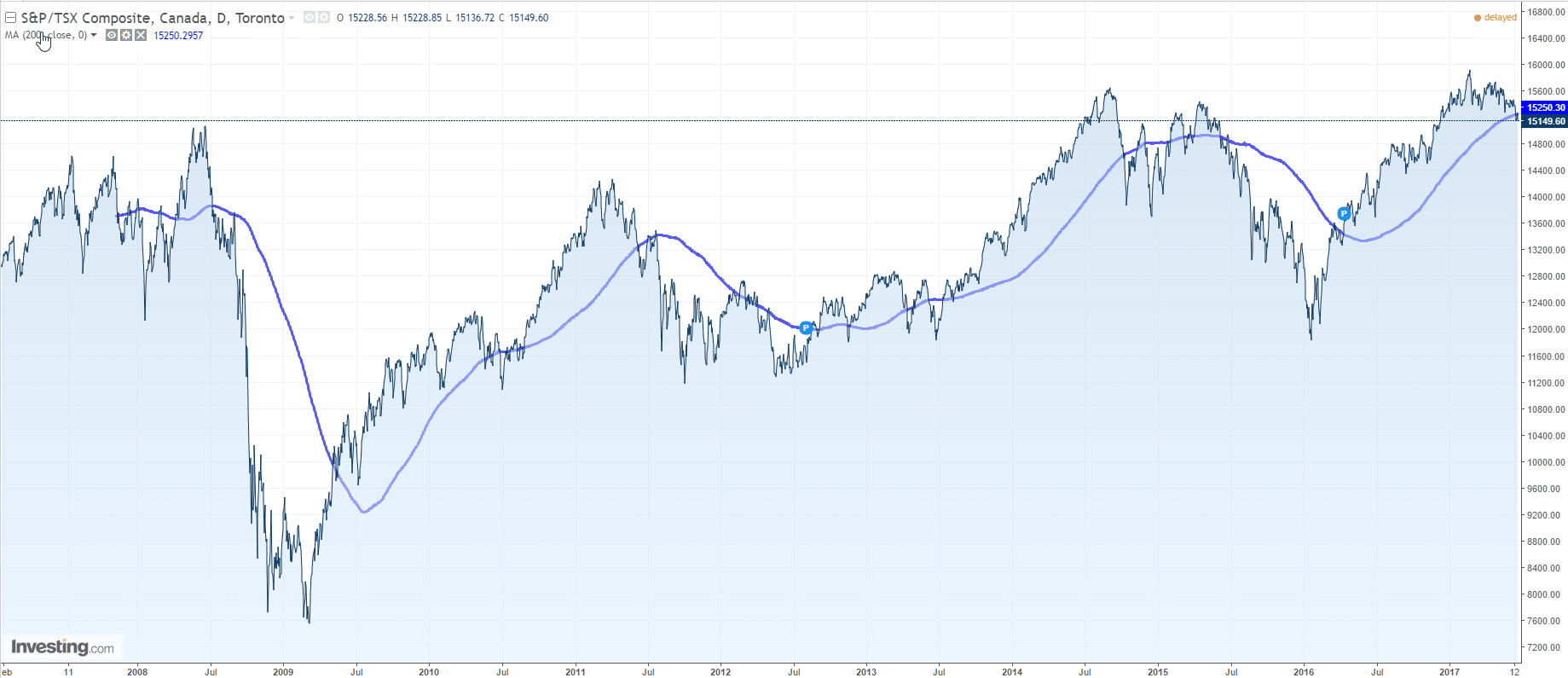

Oil prices have fallen more than 10% since the beginning of the year, in spite of the agreement reached by the OPEC members at the end of November 2016.

Time to recall some of the credit dynamics proposed in this blog.

Oil as a proxy for credit

- Oil is probably one of the variables – if not the variable – that help normalize the current macro-financial conditions.

By normalization we mean resorbing excessive credit and debt levels. Recall the great financial crisis as a credit episode: this is a long-lasting process. - As a reminder, the OPEC decided to cut its production by 4.5% the end of November 2016. As discussed at that time, given the weight of the OPEC in the global oil production, the move would have resulted in … less than 2% of the world global output.

- We believe that downturn of oil prices is related to a forced increase of supply while demand remains very soft.

- We nicknamed this macro-financial process the oil carry. We believe that it is one of the strongest deleveraging forces currently at play.

A solvency game

Think, for example, of Saudi Arabia Inc, a company that faces acute financial/solvency pressures according to its budget balance. One could actually consider other (Middle Eastern) countries that rely on oil production as their main source of income. This is precisely the topic of Nick Butler from the Financial Times. An article that pictures the rationale behind the oil carry.

Please consider ‘Oil: the market finds that the Sheikh has no clothes’ :

(emphasis ours)

“Oil prices have fallen over the last week by more than 10 per cent and, with both Brent crude and the US WTI benchmark below $50 a barrel the price stands at its lowest level in six months. Why? The straightforward answer is that the market has lost all confidence in the power of Saudi Arabia to set prices. The realisation has dawned that the sheikh has no clothes.”

“In contrast, the traditional oil producers have not been able to adjust. A study by the International Monetary Fund published a few weeks ago listed the oil price needed by a range of producers to balance their national budgets. Because of recent increases in production, Iran and Iraq have reduced their fiscal breakeven point to just over $50 a barrel, but Libya requires a price of $71, and Saudi itself, despite record production, needs $83.”

“This urgent — and in some cases desperate — need of revenue explains why any Opec agreement designed to boost prices by setting quotas and cutting output was doomed to fail. The first agreement reached in November offered the prospect of a coordinated cut but adherence to the agreement declined, leaving the Saudis alone to make up most of the difference. A second agreement was planned for the second half of this year, to be agreed at the Opec meeting at the end of May.”

“But the prospect of a coordinated response has diminished as the weeks have passed. There is a big temptation for producers to cheat on any deal. Could the Saudis continue to fill the gap themselves by cutting more? In theory yes, but in practice the kingdom is also short of revenue and clearly unwilling to make the dramatic cut in output — by 1.5m barrels a day to 2m — that would really reset the market.”

“In Nigeria, Venezuela, Russia and even Saudi Arabia itself the latest fall, and the removal of the illusion that prices are about to rise again, could be dangerously disruptive. The effects will be felt well beyond the oil market.”

Agreed. Under these lenses, the break-even prices mentioned above, i.e. the levels of prices that would enable to ‘refill’ the public accounts, are probably the best indicators for the current supply-demand dynamics. Expect it to unfold.

Credit contagion

Connecting the dots, some concluding propositions in the form of a short Q&A:

- Q: Should one expect additional production cuts?

A: Hardly if, as we believe, financial pressures continue to weigh on oil producers.

- Q: Should one expect other ‘interventions’ to support oil prices?

A: This is likely, unfortunately. More to come.

- Q: Should one expect credit contagion along the road?

A: Yes, it is already taking place.

Butler is right: “The effects will be felt well beyond the oil market”. This is part of a much broader credit repricing process whose commodity manifestations are beautifully portrayed by Reinhart, Reinhart and Trebesch.

Jacques