A real-time follow-up of our risk repricing scenario.

Moody’s downgrades China’s sovereign rating by one notch, from Aa3 to A1:

The downgrade reflects Moody’s expectation that China’s financial strength will erode somewhat over the coming years, with economy-wide debt continuing to rise as potential growth slows. While ongoing progress on reforms is likely to transform the economy and financial system over time, it is not likely to prevent a further material rise in economy-wide debt, and the consequent increase in contingent liabilities for the government. |

The outlook moves from negative Aa3 to stable A1. The message is aimed at taming fears of additional cuts. Please note Moody’s prudent wording below:

(emphasis ours)

The stable outlook reflects our assessment that, at the A1 rating level, risks are balanced. The erosion in China’s credit profile will be gradual and, we expect, eventually contained as reforms deepen. The strengths of its credit profile will allow the sovereign to remain resilient to negative shocks, with GDP growth likely to stay strong compared to other sovereigns, still considerable scope for policy to adapt to support the economy, and a largely closed capital account. |

We’ve heard this before, haven’t we?

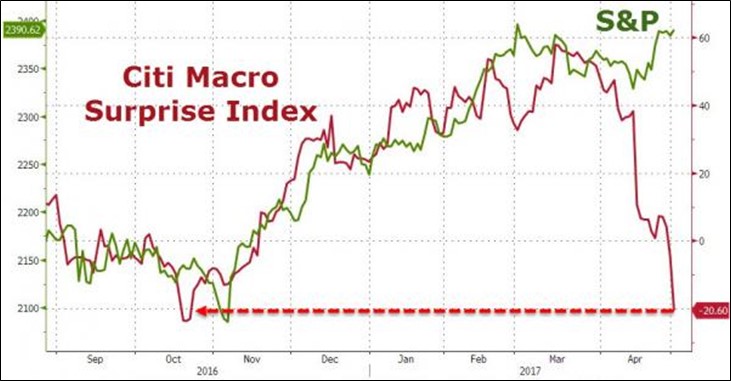

There is a macro trade-off between growth oriented policies, that traditionally rely on leverage, and financial stability. That’s the very basic of our credit repricing scenario: when sponsored by public policies, growth impetus, if any, comes at a cost.

The FT comments this issue in ‘China’s sovereign debt downgraded by Moody’s’:

(emphasis ours)

While Moody’s acknowledged China’s efforts to rebalance its economy away from reliance on debtfuelled stimulus, the agency believes progress is too slow to arrest deterioration in its financial strength. “The planned reform programme is likely to slow, but not prevent, the rise in leverage,” the agency said. “The importance the authorities attach to maintaining robust growth will result in sustained policy stimulus. Such stimulus will contribute to rising debt across the economy as a whole.” |

Agreed.

| Moody’s statement also noted that capital outflows and renminbi depreciation pressures had limited China’s scope for using monetary policy to stimulate the economy. It said this limitation would force authorities to rely more on fiscal spending. |

Agreed. The ‘limitation’ above is a financial stability loopback.

The agency mentioned slow progress on financial reforms designed to improve credit pricing and allocation, citing distortions caused by widespread assumptions that the government would bail out certain borrowers to prevent default.“The ratings downgrade is a stark warning of the risks posed by rapidly rising leverage that could prove costly even if it does not result in a financial crisis,” said Eswar Prasad, economics professor at Cornell University and former head of the International Monetary Fund’s China division. “The slow and uneven pace of banking and broader financial sector reforms suggests that little progress has been made in improving the quality of bank lending.” |

The question remains: what is the cost of excessive leverage ?

We suggest: credit repricing and slower growth down the road.

Jacques