Please consider the following post from the excellent blog ‘Never Mind the Markets’ of the Swiss German Tages-Anzeiger.

Source: http://blog.tagesanzeiger.ch/nevermindthemarkets, Bloomberg

The content deserves our attention as it is illustrative of a strong underlying trend. Here’s a short summary (the blog is in German):

The bond market has turned into a ‘wahnsinnig’ search for yield, which in the financial world invariably means higher risk.

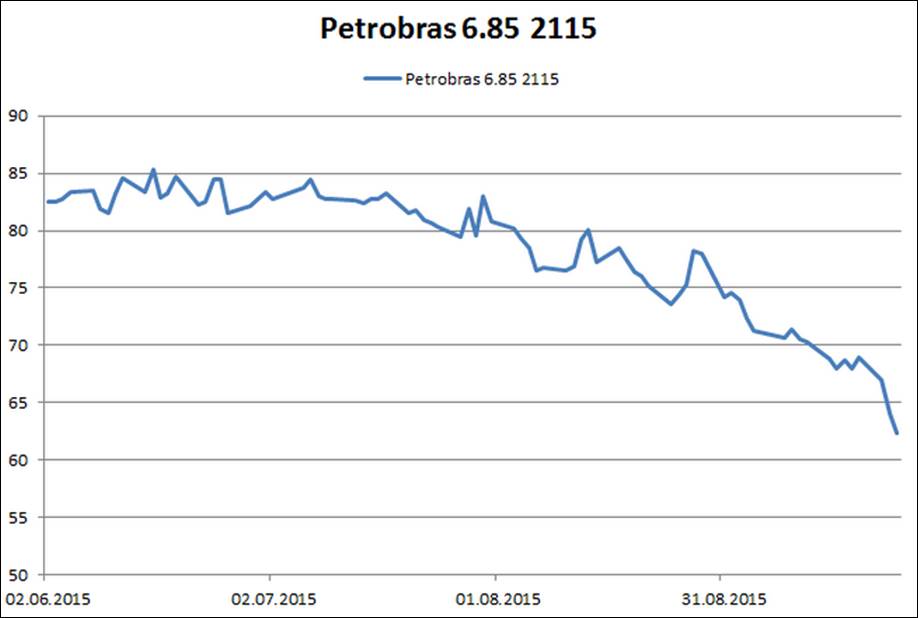

The authors mention the case of Petrobras 6.85% June 2115 (100 years !) as a good example of ‘higher risks’. Let us dig into those risks.

As a reminder, the bond was 3 times oversubscribed with one of those mammoth volume of USD 2.5 billion.

Most of the risks below were known or clearly understandable at the time of issue:

- corporate credit. Recall that Petrobras is active in the oil industry …

- sovereign credit. Brazil, the home country of the company, is in recession. Its sovereign rating has been downgraded into junk by S&P recently.

- The bond is denominated in hard USD but the company reports in real, a currency that remains under heavy pressure. In its annual report, Petrobras mentions that 80% of its liabilities are denominated in currencies other than the real.

- 100 years for y nominal yield of 6.85% ! Sign of times.

- monetary policy. The Brazilian central bank has entered a hiking spiral to fight inflation imported by a nose diving currency, which in turns weakens growth expectations.

The bond has lost more than 30% since June 2015. Any catalyst that would explain such an acceleration?

The authors rightly point to the capital flows that are pouring out of emerging markets:

„Eines der dominierenden Themen an den globalen Finanzmärkten in den vergangenen Jahren war der immense Kapitalfluss, der nach 2008 in die Schwellenländer strömte. Das hat in Emerging Markets wie China, Brasilien, Russland oder Indonesien zu einem starken Anstieg der Verschuldung in der Privatwirtschaft geführt. Und ein beträchtlicher Teil dieser Schulden wurde in US-Dollar aufgenommen… Und nun, seit einigen Monaten, hat die Gezeitenwende in den Kapitalströmen stattgefunden. Das Kapital strömt aus den Emerging Markets zurück in die USA …“

„Petrobras steht symbolisch für diese Ära: Der Konzern hat insgesamt mehr als 90 Milliarden seiner Schulden in US-Dollar aufgenommen. .Und nun kommt die Kehrseite dieses Sündenfalls, wenn man sich in einer Währung verschuldet, die nicht die eigene ist: Je tiefer der Real fällt, desto schwerer wird die Last der Dollarschulden für Petrobras. Wer weiss, vielleicht geht der Jahrhundert-Bond US71647NAN93 in die Geschichte ein. Als letzter Ausdruck des Wahns, dem Investoren in den USA und Europa in ihrem Anlagenotstand, dem Race for Yield, verfallen sind.“

In other words: the huge carry trade created by zero rates policies may have come to an abrupt end.

That is maybe what the Fed was willing to say last week: the question is not to know whether monetary normalization has to take place, but how.

Kind regards,

Jacques