In this post we take a closer look at the recent dynamics of the USD.

Relative expectations and economic surprises are now increasingly reckoned as a powerful short term driver of the USD. Yet it looks even more important to figure out how and where these expectations originated.

We view the recent volatility spikes as a result of bizarre policy guidance, in particular the set of fiscal announcements that has been taking place since the end of 2016.

We review the opinion below according to which ‘more comprehensive and better coordinated policy responses’ could dampen such volatility. True, we also see the recent FX swings as a balancing act between aggressive guidance, high expectations and fragile economic conditions. But less guidance, if any, would actually be the best answer to counter FX volatility. This will unfortunately be difficult to achieve as new policy measures seem to be the solution to all kind of economic matter, while guidance became global and synchronized.

—-

Mohamed El-Erian, the influential economist and outspoken inventor of the ‘New Normal’, reviews the impacts of the recent weakness of the USD.

Please consider: “How the dollar’s weakness is the rest of the world’s problem” by the Financial Times.

(emphasis added)

“While Americans visiting Europe find that their dollars buy less, the recent sharp weakening of the world’s reserve currency is a lot less of a problem for the US and much more for the rest of the world, where it increases already complex economic and policy challenges. It also continues a “hot potato” syndrome that highlights the underlying structural fragility of the global economy, as well as undermining the foundation crucial to solidifying and sustaining elevated asset prices.” |

“The primary driver of the dollar’s decline has been a narrowing of the differential in market expectations for economic growth and monetary policy. During the past few months, actual and expected growth has picked up in Europe and Asia, both in absolute terms and relative to the US.” |

Indeed. The ‘game of expectations’ dynamics described by El-Erian looks like a powerful 2nd derivative driver of the USD, the first one being the traditional interest rate differential, and the long-term, boring one things such as growth, deficits or purchasing power parities.

But who cares about the longer-term when each and every open market committee becomes a strategic event ?

The dynamics is of interest here. One should understand it as a function (the result) of some aggressive policy guidance :

“Concurrently, with the implied market probability of a December rise having fallen sharply (to below 30 per cent), traders have aggressively pushed back to June 2018 material expectations of the next Federal Reserve increase — this at a time when they have also been internalising signals from the European Central Bank that it may move as soon as next month in announcing plans to reduce large-scale asset purchases.” |

This, we believe, is the 2nd phase of a 3-step scenario introduced in our previous posts.

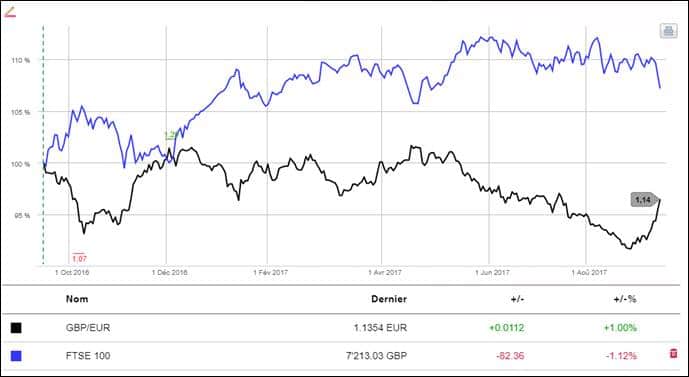

Phase 3 may have already started (in this case vis-a-vis the EUR):

- positive for the USD. The Trump (reflationary) trade leads to a set of economic surprises that support the dollar. At the same time, as the Fed accelerates its normalisation path, the short-term yield differential provides additional support to the USD;

- positive for the EUR. As the Trump trade abates and US economic surprises fade, expectations shift to Europe as the new world economic engine. The Fed is forced to reckon that inflation expectations are softer than anticipated. At the same time, the ECB initiates its taper strategy as the normalisation window of opportunity looks attractive;

- positive for the USD. European indicators stop beating excessive expectations. European surprises start to decay along the US cycle. At the same time, this is to be checked, US surprises stop bleeding and expectations revert to their mean. On the monetary front, the ECB is forced to formulate a clearer normalisation strategy, while the Fed continues to follow its path.

What about the equity market ?

“While some segments of American households and companies will suffer from the recent depreciation, the overall economic impact is likely to be favourable. By enhancing price competitiveness, it provides a tailwind for economic activity and job creation. It is supportive of financial markets, given that companies in the S&P 500 derive a significant portion of their revenues from abroad.” |

See the article by James Mackintosh in our previous note: the weakness of the USD provided a much needed boost to otherwise superficial US earnings.

But at which cost?

“The picture is less rosy for the rest of the world. Most economies now have to contend with a stronger headwind to growth and, in the case of Europe, downward pressures on an inflation rate that the central bank worries is already too low. With continued delays in implementing the much-needed set of pro-growth policies, this serves to weaken the cyclical growth impetus and amplify the effects of structural impediments to higher and more inclusive growth.” |

And El-Erian to conclude:

“Until this situation is resolved through more comprehensive and better co-ordinated policy responses, currency markets will pose a threat to the solidification of a synchronised global recovery needed to validate stock prices around the world in a durable manner.” |

We make slightly different propositions along the same lines :

- Currencies may actually help normalize the overshoot of weird monetary and fiscal policies ;

- FX volatility could definitely make things more complicated at the global level ;

- True, real growth remains fragile and needs to be more durable to justify the current valuation levels. But this is not now and currencies are not to blame: macro-credit is ;

- Real growth is not as synchronized as it looks, expectations are ;

As discussed above, the difficult reconciliation between synchronized expectations and less synchronized fundamentals is probably the engine that drives the current FX volatility.

Expect it to unfold until some more reasonable guidance is proposed. Or even better : less guidance in the first place.

Jacques